Besides reinforcing in my mind's eye what I already know works well, I use this page

to document new trade ideas and other things I find interesting.

Questions or comments?...Contact me at sharpshorts2000@yahoo.com

My trading jargon...Click this link for definitions of the terms and abbreviations I use.

▶--------------------------------------------------------◀

12/28/2018 The MACD EMA TURN

The markets have been very volatile lately -- fast action with wide ranges.

I've been keying on the MACD EMAs for entering trades...

in particular, watching MacTurn prints: ♦

This link goes to a post made on iHub -- an 8 trade, 12 minute period of opportunity...

12/07/2018 Another new chart template...

Acceleration/Deceleration Oscillator

10/25/2018 Another new chart template...

10/06/2018

The title bar is the Template -- explanation:

The explanation is describing the attributes for the left hand chart. The right hand chart

has some differences thus it has it's own template title. My layouts display different

templates for different time frame charts but all the indicator parameters are very similar.

These show my current "Apply Template" list with some of the templates applied on

different time frame charts. They are saved within the software itself but can also be saved

as an .xml file on my machine which can be emailed to other users who run ApexTrader.

09/17/2018

Noticed this anomaly...

8/29/2018

Different templates for different time frames but the same indicators arranged differently

Some of the APEXTRADER chart tools I use

8/08/2018...A favorite set of ENTRY signals

Constantly repeating reversal patterns

This example combines many of the Price Action and indicator signals I use to take bits-and pieces

out of the markets...the shorter term the chart, the more frequently they repeat

07/26/2018 - Customizing the indicators

Applying different moving average types to standard indicators can smooth them out a bit

without significantly changing their 'signaling' shapes.

In the price pane - a standard MACD histogram (12-9-26) along with its Signal EMA.

In the 1st study - 3 period SMA applied to the MACD histogram (4 period SMA EMAs).

The yellow line is a custom Stochastic Indicator showing the SlowD (5 - 3 SMA - 3 SMA).

In the 2nd study - MACD with a 5 period (Linear) Least Square MA of the Stoch SlowD.

06/08/2018...Good month so far

This is how I keep track of my trading activity on a daily basis.

Across the top are the cumulative numbers for all trade results since 2013.

Each trade and its results are recorded on the left. On the right are the

statistical summaries that are automatically updated as data is added on the left

Along the bottom are tabs for the other workbooks I use to analyze my trading.

For details see step 1 in the Table of Contents - STATISTICS & Spreadsheets

Ignoring your statistics will lead you to ruin

▶-------------------------------------------------------◀

06/03/2018...1st session of June

A 'rare' gap Open following Fridays' excellent jobs report

...I'm still trying to figure out what time is used for the "Prior Settle" statistic...

Most days it looks like it's the 4:15 PM session break but on other days, not so much...

▶-------------------------------------------------------◀

05/30/2018...Was yesterday just a big head fake?

Right back into the consolidation channel today...

-- instead, a new possibility --

05/11/2018...News and market action

****Closing a week of "good" news****

3 American citizens released by North Korea and 5 major terrorist leaders captured in Syria

****The "bad" news on the TA front****

Stochastic is over-bought and candles look very much like just before last month's reversal

▶-------------------------------------------------------◀

04/13/2018...REMINDER !

Don't let a good day turn against you. Be alert, the world needs more lerts.

Quit while you're ahead, hit 'em and run, know when to say when...

Link to current day's trades Apr 2018

Trading can be a constant battle between your greed and yourself...

▶-------------------------------------------------------◀

04/22/2018... MACD and LSMA Indicator Combinations

Applying a Least Square Moving Average to your standard indicators can "smooth" them out

(without significantly altering their original relationships with prices)

04/09/2018...Multiple applications of the Least Square MA

Below - very similar to the template above except that 2 LSMA lines and LSMA histogram

are with price...the study contains the MACD+EMAs with a LSMA applied to STO (hidden)

04/03/2018...Added an LSMA of STO%D

In the price pane there is a blue "Step Line" LSMA (parabolic) along with MACDh and its Signal line.

The red--lime line in the study pane is an 8 period Least Square Moving Average (linear)

which is based on the input from the yellow Stochastic TA %D...

The white dots print when the LSMA first turns from down to up.

04/03/2018...MACD with Least Square Moving Ave

The light blue histo in the price pane is a 6 period LSMA of the darker blue MACD histo

The LSMA can also be displayed as a Line, a Step Line or a histogram...

I'm experimenting with those display types along with other periods

▶-------------------------------------------------------◀

03/29/2018... MacH vs Awesome Oscillator

Price OHLC with MACD histogram (12,9,26) over a combined study including

Stochastic slowD (5,3,3), MACD EMAs (12,9,26) and Awesome Oscillator (5,10) histogram.

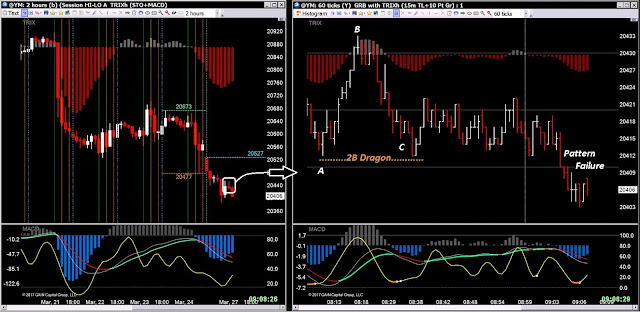

03/11/2018...2 TRIXh w Price

03/09/2018... Divergence types

In depth descriptions are on pages 2, 2a and 2b in the table of contents on the right...

02/22/2018 -- Keltner channels (2.1 deviations)

Left chart - Keltners+center band...Right - Keltners+MACD histogram

T-Mode 2 study with Keltner Channels on the left...Longer term 1 study with Keltner channels

and MACD Histogram plus MACD Signal line

Also added horizontal level lines, aligned with the MACD scale on the right

T-Mode 1 study with Keltner Channels and Stochastic...

Slightly longer term 1 study with Keltner channels

Same T-Mode chart with different templates applied

▶-------------------------------------------------------◀

01/24/2018 -- Some T-Mode chart template modifications

Single study -- MACD with price over Stochastic

2 study -- MACDh w price over Stochastc over MACD

1 study -- Stochastic over MACD

▶-------------------------------------------------------◀

01/13/2018 -- impressive start for the new year

01/02/2018 -- odd trading ranges today...

11/11/2017...Testing the Acceleration/Deceleration Oscillator & AC HOOK

Perhaps good for taking multiple, very small scalps using a Buy-Stop above the bar

Here's a combo of the STO, MACD EMAs and APO

Another combo - STO, MAC Signal and AO

11/3/2017...New Multi-study Templates

Eliminates the scales on the left hand side...

NOTE - These two templates DO NOT save properly after shut-down//restart

or when loading either one to an open chart...

(the TRIX remains in the Active Indicators property box but it reverts to just a line on the chart)

In order to get TRIX added without the LH scale, you need to right click the pane that you want

it shown in, select "Indicators" and then uncheck the "Create New Area" box.

12/28/2018 The MACD EMA TURN

The markets have been very volatile lately -- fast action with wide ranges.

I've been keying on the MACD EMAs for entering trades...

in particular, watching MacTurn prints: ♦

This link goes to a post made on iHub -- an 8 trade, 12 minute period of opportunity...

12/07/2018 Another new chart template...

Acceleration/Deceleration Oscillator

10/25/2018 Another new chart template...

10/06/2018

The title bar is the Template -- explanation:

The explanation is describing the attributes for the left hand chart. The right hand chart

has some differences thus it has it's own template title. My layouts display different

templates for different time frame charts but all the indicator parameters are very similar.

These show my current "Apply Template" list with some of the templates applied on

different time frame charts. They are saved within the software itself but can also be saved

as an .xml file on my machine which can be emailed to other users who run ApexTrader.

09/17/2018

Noticed this anomaly...

8/29/2018

Different templates for different time frames but the same indicators arranged differently

8/08/2018...A favorite set of ENTRY signals

Constantly repeating reversal patterns

This example combines many of the Price Action and indicator signals I use to take bits-and pieces

out of the markets...the shorter term the chart, the more frequently they repeat

07/26/2018 - Customizing the indicators

Applying different moving average types to standard indicators can smooth them out a bit

without significantly changing their 'signaling' shapes.

In the price pane - a standard MACD histogram (12-9-26) along with its Signal EMA.

In the 1st study - 3 period SMA applied to the MACD histogram (4 period SMA EMAs).

The yellow line is a custom Stochastic Indicator showing the SlowD (5 - 3 SMA - 3 SMA).

In the 2nd study - MACD with a 5 period (Linear) Least Square MA of the Stoch SlowD.

06/08/2018...Good month so far

This is how I keep track of my trading activity on a daily basis.

Across the top are the cumulative numbers for all trade results since 2013.

Each trade and its results are recorded on the left. On the right are the

statistical summaries that are automatically updated as data is added on the left

For details see step 1 in the Table of Contents - STATISTICS & Spreadsheets

Ignoring your statistics will lead you to ruin

▶-------------------------------------------------------◀

06/03/2018...1st session of June

A 'rare' gap Open following Fridays' excellent jobs report

...I'm still trying to figure out what time is used for the "Prior Settle" statistic...

Most days it looks like it's the 4:15 PM session break but on other days, not so much...

▶-------------------------------------------------------◀

05/30/2018...Was yesterday just a big head fake?

Right back into the consolidation channel today...

▶-------------------------------------------------------◀

5/18/2018...Last week's reversal speculation hasn't happened -- instead, a new possibility --

05/11/2018...News and market action

****Closing a week of "good" news****

3 American citizens released by North Korea and 5 major terrorist leaders captured in Syria

****The "bad" news on the TA front****

Stochastic is over-bought and candles look very much like just before last month's reversal

▶-------------------------------------------------------◀

04/13/2018...REMINDER !

Don't let a good day turn against you. Be alert, the world needs more lerts.

Quit while you're ahead, hit 'em and run, know when to say when...

Link to current day's trades Apr 2018

Trading can be a constant battle between your greed and yourself...

▶-------------------------------------------------------◀

04/22/2018... MACD and LSMA Indicator Combinations

Applying a Least Square Moving Average to your standard indicators can "smooth" them out

(without significantly altering their original relationships with prices)

04/09/2018...Multiple applications of the Least Square MA

Additional templates with MACD and LSMA combinations

Below - very similar to the template above except that 2 LSMA lines and LSMA histogram

are with price...the study contains the MACD+EMAs with a LSMA applied to STO (hidden)

04/03/2018...Added an LSMA of STO%D

In the price pane there is a blue "Step Line" LSMA (parabolic) along with MACDh and its Signal line.

The red--lime line in the study pane is an 8 period Least Square Moving Average (linear)

which is based on the input from the yellow Stochastic TA %D...

The white dots print when the LSMA first turns from down to up.

04/03/2018...MACD with Least Square Moving Ave

The light blue histo in the price pane is a 6 period LSMA of the darker blue MACD histo

The LSMA can also be displayed as a Line, a Step Line or a histogram...

I'm experimenting with those display types along with other periods

Other variations - colorized MACD histo with LSMA as a Step Line

Here the MACD color is set to transparent with the LSMA shown as a histogram ▶-------------------------------------------------------◀

03/29/2018... MacH vs Awesome Oscillator

Price OHLC with MACD histogram (12,9,26) over a combined study including

Stochastic slowD (5,3,3), MACD EMAs (12,9,26) and Awesome Oscillator (5,10) histogram.

03/11/2018...2 TRIXh w Price

03/09/2018... Divergence types

In depth descriptions are on pages 2, 2a and 2b in the table of contents on the right...

02/22/2018 -- Keltner channels (2.1 deviations)

Left chart - Keltners+center band...Right - Keltners+MACD histogram

and MACD Histogram plus MACD Signal line

Also added horizontal level lines, aligned with the MACD scale on the right

Slightly longer term 1 study with Keltner channels

▶-------------------------------------------------------◀

01/24/2018 -- Some T-Mode chart template modifications

Single study -- MACD with price over Stochastic

1 study -- Stochastic over MACD

▶-------------------------------------------------------◀

01/13/2018 -- impressive start for the new year

01/02/2018 -- odd trading ranges today...

11/11/2017...Testing the Acceleration/Deceleration Oscillator & AC HOOK

Perhaps good for taking multiple, very small scalps using a Buy-Stop above the bar

Here's a combo of the STO, MACD EMAs and APO

11/3/2017...New Multi-study Templates

Eliminates the scales on the left hand side...

NOTE - These two templates DO NOT save properly after shut-down//restart

or when loading either one to an open chart...

(the TRIX remains in the Active Indicators property box but it reverts to just a line on the chart)

In order to get TRIX added without the LH scale, you need to right click the pane that you want

it shown in, select "Indicators" and then uncheck the "Create New Area" box.

10/14/2017...Time Based vs Tick Based

These comparisons illustrate why I prefer tick charts for viewing very

short term price action. It's difficult to correlate the different chart types...

09/26/2017...Add'l T-Mode template

TRIX histogram in with price over Stochastic, with dual MACD's and EMA-MAC triangles

The MACD histograms alternate being 'on top' every other time the program is opened.

0922/2017...Current T-Mode template variations

The right hand one may hi-lite the MT Sling pattern better...

(two of them printed between 14:00 and 14:01)

09/20/2017...Revisiting the 1-2 Punch combo

Stochastic TA (5,4,3) Hooks up and then the WMA (4) of the MACD Main EMA turns up

Note the MACD Histo slope is also positive...the MACD Signal EMA is slower

but turns positive just a few bars later...I consider the MACD Signal to indicate TREND

1 to get ready and 2 for the dough...

08/30/2017...A Trend Following template set

The study contains a filled MACD histogram (Area not Columns)

4 period WMAs are applied to the MACD EMAs along with Coloring and Show Cases.

White or red candles/bars are 'normal' up/down colors

The lime candlesticks and/or OHLC bars' are colorized via the WmaMac EMA slope.

Stochastic %D is placed in with price for a "Trigger" signal.

Same chart, candlesticks or OHLC

08/22/2017...I love the look of divergences in the morning...

...Especially when they keep on giving

8/29/2017 -- Another early morning divergence that kept giving

07/30/2017...New Entry chart templates

Experimenting with placing the Stochastic (5,4,3) and WMA (5 period) of

the main MACD EMA (12,9,26) in with price.

Also added add'l templates of STO with MACWMA lines+dots

07/24/2017... The 1-2 punch REVERSAL set

Signals from the oversold stochastic HOOK combined with the WMA-MAC-EMA turning UP

Another example a little later in the afternoon:

and the 55 tick chart from above that also shows a "failed" entry just minutes before:

Another template style for the One-Two Punch:

07/18/2017...Reacting to bottom reversals

First the stochastic hints then the MACD EMAs confirms...

As simple as it gets...it does require combining "feel" with the entry decisions.

Have more confidence in the simple 1st-the-STO and the-MAC-EMAs-to-confirm pattern

when you see your old friend DIVergence too...

07/05/2017...Brach Zone pull backs

A way to anticipate reversals that may occur...IE: a "guess" for order entry placement.

Sometimes works well, especially if the higher time frames suggest trend reversal clues...

This occurred over a one hour period

BZ entries AFTER a reversal has shown itself:

A different set of examples showing the BZ on the lower TFs.

Note the Reversal 2B and the add'l entry signals before each of the retraces ...

and a look at the same price action on the higher TF's

06/29/2017...P/A + Indicators

P/A + Indicators + Multiple Time Frames

6/25/2017... MACD in Price Paneand reviving TRIX + STO in the study.

6/23/2017...DOM, Quotes and T&S

Combined ApexTrader and Medved Trader or w/o Medved

06/21/2017... DIVergent Stochastic Re-Hook

06/19/2017...Reviving the BLINE

Also moving the MACD histogram in with price leaving it's EMAs in the study pane with Stochastic %D.

This allows for a smaller, less busy study pane and also enlarges the price pane.

06/15/2017...Simple?

But I've been seeing various combinations of this stuff for so long that it IS simple to me...

Basically I use trend lines, price action patterns and indicator patterns.

AND multiple time frames help to confirm or clarify the repeating patterns of all the stuff I use.

06/12/2017...The old two step pattern

Two drives down before reversing and going up

30T on left...

Positives -- Potential for a 2B with the STO about to hook up ... ... ... ...

Negatives -- down sloping MACD EMAs and NO histo divergences

45T on right...

Positives -- Potential 2B, STO Hook and is divergent, slight Histo DIV

Negatives -- down sloping MACD EMAs ... ... ... ... ... ... ... ... ...

Below -- another day, another two step pattern set

05/25/2017...Be ready to abandon patterns...

Don't lock yourself into a position.

AND see what happened afterwards...

05/19/2017...MT for trend - STO for when

A nice reversal:

05/16/2017...Waiting for better signals to Enter

These two sets show why you are better off waiting for better signals.

The 1st set shows an entry with a "marginal" signal -- Stochastic Hook

This set shows better signals that followed afterwards -- MT SLING

05/09/2017...Using multiple time frames

Very often I use all three for spotting signals for entries...T-Mode entry charts (left 2)

and trade results (right)...also good for documentation and for later review.

But at other times, signals don't fail...

These next charts show what happened after getting stopped out on the trade shown above

(see the horizontal arrow on the right hand chart)

Price went on to form a DIVergent 2B bottom with an MT SLING as the entry signal

(see the vertical arrow)

A downtrend reversed by a divergent 2B, then a Trend line break followed

by a TLB Re-Test (MOF) and then a MAC Trend Slingshot

05/03/2017...5 Wave ascending triangle

... bottoming reversal pattern was pre-announced by the histogram divergences

propelled up by the MAC Trend Slingshots while suggesting

an initial target @20856 (the session open price).

05/02/2017...Time and Tick

Same time period, very different look.

5/01/2017...Breakout then a Flag on a pole

Long term pattern and short term

04/27/2017...Price Bar & Candle color themes

30T+60T 60T+90T Lower monitors

Good signals sometime FAIL to precede good reversals -- using Buy-Stops

can often keep you out when signals fail...tho you gotta cancel them...

04/21/2017...An explanation of the Indicators I use

Most charts have price with a TRIX histogram over a study combining MACD & Stochastic.

I also apply Show Case 'Paintbars' and Coloring tools.

04/20/2017...

The dual MACD histos allow better control of the Signal/EMA lines.

They stay within the study pane now....Also trying out price-line charts

04/07/2017 ... Time on my hands ...

but it's nice to have options for the ol' layout and mix it up here 'n there

4/07/2017 ... Bombs away ! is apparently bullish

4/05/2017... A TIGER!...a f'n tiger

I forgot all about the FED minutes release today.

And here I thought what the FED would say was old news...

Apocalypse NOW!

Remember the cook's rant "Never get out of the boat"... He ended up losing his head.

NEVER forget the FED.

03/27/2017...Trying to set up a bottom

03/23/2017...Trying a new "trigger" for T-Mode charts

03/20/2017...Zeroing in across time frames

Reading a 3 month daily, 2 hr-5 session, 1hr-2 session and the current session

03/18/2017...The Charting Arts

Examples of the things that can be done with great software...

03/16/017...The ol' 2-step...

03/15/2017...Market Pace and Time of day

In general, the markets are most active between 9:30 and 10:00 AM. The pace of market activity

varies greatly throughout any trading session. I've touched on this subject before...

It's explained somewhat more in-depth on Table of Contents page 7.

I contend that price action is price action, no matter when you decide to place your trades.

Pattern relationships between price and indicators remain the same regardless of the time of day.

Market pace determines how much time passes before patterns complete. The in-and-out trade below

would only take about 3 minutes during very active market Times.

03/07/2017...Different TF can make different Signals

Even minor time frame changes can show you stuff...

03/03/2017...Time Frames and Indicator Relationships

You have to really study the minutia to see the subtle differences.

02/20/2017...Different software will print different charts

Comparing the ApexTrader and Medved Trader charting software rendering reveals

subtle differences that are common to all software programs. These two charts are set up very similarly

but it is difficult to get them to match exactly even though they are using the same data feed.

I like the look of the timing curves produced by Apex's Stochastic (TA) but am unable to replicate

the EXACT same shapes and turns by manipulating Medved's fast or slow stochastic indicators.

Another issue I'll have to get used to is the differences between the tick-per-bar settings.

Apex's 40 tick chart is approximately equal to Medved's 13 to 16 tick chart...

02/16/2017...Like shooting ducks in a barrel

Simple as 1-2-3, easy as A-B-C

02/15/2017...Patterns

Perfect pennant on a pole - limit entry at lower trend line (@ 5)

or a buy-stop at upper trend line for the breakout.

Another look - another trade

02/13/2017...MACD trends

01/25/2017...DIV REVERSAL - With & W/O annotations

01/17/2016...Cluster WAG Entries

Luck can have something to do with it

12/18/2016...Playing with indicators

Differing indicators can be manipulated to show very similar results...

Here I'm comparing a couple of TRIX EMAs with a standard MACD.

12/08/2016...WMA HOOK

This signal is slightly slower to print than the TRIXh Slope (gray histo) and the

TRIXh BLINE (white dots on TRIX histo). The STO (yellow line) hooks up at about the same time

while the TRIX Signal line (fuchsia+aqua) and the MACD Signal line (red+lime)

coloring print just afterwards.

Another example on two time frames

12/02/2016 MAC-Trend and TRIX-Trend

Almost identical turns are high-lighted on the EMAs

11/10/2016...chart set up

11/05/2016...Variations on the BLINE theme...

- - -Trend indicators- - -

The MACD Signal EMA tuning positive and TRIX histogram sloping up.

11/01/2016...Back to the BLINE

I'm still testing the BLINE ...It's based on the TRIX indicator which is set as a histogram.

I've applied the formula to show on the histogram bars and on the price bars.

Variations of BLINE indicators on Candle and OHLC charts

10/20/2016...Playing with Painted bars

Paint-bar tests - These chart experiments have the normally white price OHLC bars change to

lime when-ever the MACD Signal EMA is sloping up.

They then get colored red when-ever the stochastic %D gets highly over-bought and begins to drop.

I am not using these paint-bar colorings except to get a feel for how they work, perhaps

for finding other possible variations should they seem helpful for reading Price Action.

10/19/2016...Run up...Retreat...Re-enter

Been noticing a lot of these 3Rs of late...roughly 50% retrace for good re-entries.

09/28/2016...Testing a new layout

Overlaying the smaller sized chart over a larger on the same monitor gives a unique perspective.

These snapshots show the set up across my lower three screens.

The arrow placement is approximately at the same spot across the 6 charts.

T-Mode screen - M4

Mid Term perspective - M5

Long term perspective - M6

09/22/2016... 4a....BLINE trade Pattern ...

I added a new page explaining how to use it, it's draw backs and it's usefulness.

09/20/2016...The BLINE...6 for 6

Hard to believe you can scalp bits and pieces using signals from a 30 minute chart!

Six consecutive winning BLINE signals with a little help from your friends (stochastic).

(Slightly less than 3 complete sessions)

5 out of 7 winners on the 15 minute chart aint too shabby either!

(Slightly more than a full session)

09/16/2016...Some new Templates

Left - MACD histogram with price, MACD EMAs with Stochastic

Center - MACD histogram with price, TRIX EMAs & histogram with Stochastic

Right - TRIX histogram with price, MACD with Stochastic

Hollow candles with MACDh over STO+TRIXh+TRIX EMAs

Hollow Candles with TRIXh over STO+MACD

Signals on 3 time frames

09/06/2016...Still experimenting with my BLINE indicator

Seems it can be useful on longer term charts.

Very often MT and MAC histo will be negative or not displaying divergences

to be of much use for getting a heads up on potential reversal areas.

BLINE and stochastic signals are quicker to print.

I added the BLINE to my LT 'spotter' charts and removed them from my trade charts.

09/08/2016...+$250 per contract

BLINE signals on a longer term tick chart along with my other

'standard' old reliable signals

The BLINE prints too often with too many false prints as you zero down the time frame.

This was epecially noticeable on my trade-mode tick charts but happens even on the 1 and 3 minute.

09/03/2016...Wyckoff Power Charting

From StockCharts blogs by Bruce Fraser...his explainations of

Wyckoff's market action are very similar to how I view price Action...

09/01/2016...Back to basics...KISS

Time frames, Divergence and MT SLINGs

8/31/2016...Back to basics

The old 2 step to profits...

Step 1) Test the market while watching multiple time frames

Step 2) Wait for confirming signals across the LT and ST

Pull backs...another basic entry technique using rising MACD EMAs...

8/19/2016...Back to basics...KISS

Trend Line breaks, Divergence, Mac Trend, Slingshot and multiple Time Frames

8/16/2016...BLINE update

I've shelved my BLINE idea for now...

It's not as reliable a signal generator as it first seemed to be - too many 'false' signals...

08/07/2016 Sunday night..."Slow Motion" markets

...P/A is P/A regardless of when you trade...It pays to trade the pre-market...

It's a good time to try out new trade ideas and/or new strategies.

It may test your patience but you if you can keep your attention sharp it's sort of like

the markets go into "slow-motion"...This one took over a half hour in-and-out...

If this trade was put on during the MMO it would have been over in 4 minutes or less.

08/07/2016...Latest BLINE templates

The indicator is working well on Tick or Time based charts.

Like all indicators you still need to use your judgement when acting on its signals.

08/02/2016...TRIX-TREND-HOOK (BLINE)

Here's another idea for getting some help spotting good SLINGs or STO Hooks

using TRIX Trend in instead of MAC Trend.

It uses an EMA applied to the TRIX 5 period line which is already a combination of EMAs...

08/02/2016...Bline update

Can't get the Bline indicator to work as I had hoped it would work...

the Show Case indicators won't update properly on the stochastic line.

07/31/2016...Bline

Added another 2 templates with much slower stochastic indicators. Testing to see if they

can be helpful for spotting MT SLING patterns or if they are too much added clutter.

Borrowed "Bline" from Buffy of daCharts.com (but not her parameters).

07/26/2016...Hunting for REVERSALS

It may test your patience but you if you can keep your attention sharp it's sort of like

the markets go into "slow-motion"...This one took over a half hour in-and-out...

If this trade was put on during the MMO it would have been over in 4 minutes or less.

08/07/2016...Latest BLINE templates

The indicator is working well on Tick or Time based charts.

Like all indicators you still need to use your judgement when acting on its signals.

08/02/2016...TRIX-TREND-HOOK (BLINE)

Here's another idea for getting some help spotting good SLINGs or STO Hooks

using TRIX Trend in instead of MAC Trend.

It uses an EMA applied to the TRIX 5 period line which is already a combination of EMAs...

Using the BLINE... [TRIX TREND (TT) plus STO HOOK]

Another template with the MACD in with price, the TRIX histos moved into a new study.

I have never liked to use multiple study panes but this template set-up isn't too bad...

Plus the TRIX histos pane can be made to disappear for all intents and purposes.

So far this new indicator is showing terrific promise for timely entries...

It's working across multiple time frames and multiple markets.

It seems to catch price before it explodes up and does not require a large initial stop...

Can't get the Bline indicator to work as I had hoped it would work...

the Show Case indicators won't update properly on the stochastic line.

07/31/2016...Bline

Added another 2 templates with much slower stochastic indicators. Testing to see if they

can be helpful for spotting MT SLING patterns or if they are too much added clutter.

Borrowed "Bline" from Buffy of daCharts.com (but not her parameters).

07/26/2016...Hunting for REVERSALS

Experimenting with having a small 60T and 90T docked in the same window with the 30T T-Mode.

It fits on a single screen and makes entry signal comparisons simple - IE: no need to scan 3 different monitors before placing an order...

Plus it enables a simultaneous "one click capture" snapshot of entry signals across three time frames.

I still display larger charts too - they are needed for drawing trend lines and for the bigger picture they provide...snapshot below shows the chart set up...

(Apart from the 2xD earlier on the 30T, no particularly 'good' signals were showing when I snapped the picture)

(Apart from the 2xD earlier on the 30T, no particularly 'good' signals were showing when I snapped the picture)

07/24/2016...MT SLINGs "Late to the party" continuations

A stand alone Slingshot can be a good signal to enter a position in the early stages of reversals.

A Slingshot that's associated with up sloping or horizontal MACD EMAs is the better trade.

MAC Trend + Slingshot continuation pattern...MT SLING

Another multi time frame look at MT SLINGs

07/22/2016...MT SLINGs on higher time frames

I'll be tracking this idea...perhaps it'll prove to be a way to cut down on stop-outs when anticipating moves

yet still enable participation in the price explosions provided by good MT SLINGs.

07/20/2016...Reversal vs Consolidation patterns

There's no telling how strong an effect divergence will have on P/A after it forms

so always be looking for confirming signals...

But also be aware that a bigger consolidation pattern can go either way

and can change bullishness into bearishness.

so always be looking for confirming signals...

But also be aware that a bigger consolidation pattern can go either way

and can change bullishness into bearishness.

07/14/2016...More MAC Trend Slingshot ideas

Although it does occur with divergences at bottoms, the MT SLING pattern

is more often a trend continuation trade than a bottom reversal trade.

Slingshots occur very frequently but often form without any other confirming signals...

Relative to the "failure" rates of stand alone Slingshots vs MT Slingshots,

those that form with a horizontal or up-sloping MAC Trend are the better trades to take

Relative to the "failure" rates of stand alone Slingshots vs MT Slingshots,

those that form with a horizontal or up-sloping MAC Trend are the better trades to take

07/13/2016...Lunch time Price Action signals...

07/08/2016...New triangle ID'ed on the daily ...

♪♪ Where to now St. Peter? ♪♪

It's the old triangular consolidation pattern within a larger megaphone pattern...

The triangle is defined by the doji star top on Monday July 4th, followed by a wide range sell-off Tuesday

and a long tailed hammer reversal on Wednesday...

To top it all off, yesterday's wide range doji formed a nice indecisive diamond pattern...

With all those contradictory bullish-bearish clues it's No wonder the over night is up!!!

The indecision turned bullish - BREAK OUT!!!

The triangle is defined by the doji star top on Monday July 4th, followed by a wide range sell-off Tuesday

and a long tailed hammer reversal on Wednesday...

To top it all off, yesterday's wide range doji formed a nice indecisive diamond pattern...

With all those contradictory bullish-bearish clues it's No wonder the over night is up!!!

The indecision turned bullish - BREAK OUT!!!

07/01/2016...Use multiple TF's to advantage

In this example the 90 tick shows a TLB after a bottom was put in. I thought I had missed the play...

But then price pulled back as the MT trend continued moving up ...the stochastic was falling fast, setting up the potential

for an MT SLING. ..The 45 tick was already very O/S and then developed a HOOK signal for entry...

06/29/2016...P/A Divergences

06/18/2016...TLB and Late-to-the-Party

Back to back trade opportunities happen very frequently.

The 1st one uses a P/A event for the entry, the 2nd uses an indicator Signal for the entry.

The 1st one uses a P/A event for the entry, the 2nd uses an indicator Signal for the entry.

09/19/2016 Sunday night...the HOOK

Just some observations...Time Frames and indicator Signals in the early hours of the new session...

Some more observations...Time Frames and indicator Signals

06/17/2016..Just a WAG for a scalp

You can over-think & miss good trades. Discretionary trading is like that but there's ALWAYs another trade. Bullish

I require continual reminders - to refrain from taking too many "marginal" entries and to limit over-trading....

I require continual reminders - to refrain from taking too many "marginal" entries and to limit over-trading....

.06/13/2016...ApexTrader charting

Here are some of the automatic 'annotations' that can be added via the software.

06/03/2016...What goes down must go back up

Chasing the reasons WHY is silly...

Just accept that markets continually rebound from down-to-up...concentrate on taking money from the moves.

06/02/2016...Feel vs Hard STOPS

A $9 gain vs a $6 loss (after commissions).

06/01/2016 MAC Trend or TRIX Trend

The MACD and TRIX EMAs are very similar in their formula design.

A standard 12/9/26 MACD indicator is in with price... in the study, TRIX indicator lines use 9 and 10 periods...the histogram is a 5 period

A standard 12/9/26 MACD indicator is in with price... in the study, TRIX indicator lines use 9 and 10 periods...the histogram is a 5 period

05/17/2016...Signals (early in the new session)

Here is a trade example using the signals that fired on the longer term chart (75T on the right).

The shorter term (45T - left chart) was indicating conflicting signals at the time of entry...

MAC Trend (MACD EMAs) was strong on both time frames.

MAC Trend (MACD EMAs) was strong on both time frames.

05/12/2016...Lunchtime reversal

Longer term Time based charts can be used just as effectively as

shorter term tick based charts for spotting good opportunities...

15 minute - long lower shadow...3 minute - 3xD at the low and MT SLINGS

04/29/2016...Perspectives for Trading Charts

There's no magic formula for picking combinations of time frames that work best.

T-Mode On-chart trading does eliminate a number of price bars when it's enabled on a chart.

04/28/2016...Negative MT SLING pattern

I've been seeing this pattern for a long time...I'm not currently using it as a rational to short...

The arrow shows an inverted MT SLING pattern with the MAC EMAs divergent to price.

This one also happened to co-inside with a price double top.

04/22/2016...MOF Reversal pattern

MONEY ON THE FlOOR - a recurring pattern that can be taken advantage of every day.

MAC TREND SLING - another constantly recurring pattern.

The long term for perspective...note the subtle differences between the indicator positions on the two shorter term bar charts

Multiple Time Frames

Sometimes they print different signals, sometimes the same and sometimes only one time frame prints signals.

MAC TREND SLING - another constantly recurring pattern.

The long term for perspective...note the subtle differences between the indicator positions on the two shorter term bar charts

Multiple Time Frames

Sometimes they print different signals, sometimes the same and sometimes only one time frame prints signals.

Anticipate by Visualizing

Reversal trading requires a lot of feel for the trade. A well developed feel can enhance your results.

Below are two charts showing realistic entry placement possibilities that combine Price Action patterns

with indicator signals across two different time frame charts.

You could guess and place an order somewhere between A and B...but you won't know if prices will continue down at C.Waiting for additional signals to identify potential reversals before order placement improves the odds of a successful trade.

Note on the 35T chart that you would have needed to enter on a down sloping stochastic at E, anticipating a STO hook

04/18/2016...Missed trades

Great signals fired on two time frames...missed an entry by a tick.

You can't catch them all but there will ALWAYs be another trade opportunity.

04/14/2016...Manage your trades

04/13/2016... Judging Targets from Signals

Use Test trades to help determine whether or not to take actual trades .

Realistically mark entry possibilities after good signals fire and measure the ranges that print.

Could money have been taken out?

04/05/2016...MT SLINGSHOTS

What goes down must go up . . .

(by how much is always the conundrum)

MACD Trend SLING - - good for front running reversals

The 10 minute chart on the right is longer term than what I use but the idea is the same.

Look for the stochastic to start hooking up while the MACD EMA lines begin to slope upwards

(both should be nearer the bottom of the study)

The potential for breaking a down trend line and the longer lower candle shadows are

additional clues to add to the signals mix.

additional clues to add to the signals mix.

03/28/2016...Anticipate potential P/A patterns

You won't always be correct about what you think may happen

but this is a good habit to develop for enhancing your feel for the trade.

but this is a good habit to develop for enhancing your feel for the trade.

03/23/2016...Utilize a Buy-Stop Entry Technique

Doing so can weed out some "marginally good" trades that may get stopped out...

Whether your entry rational is based on your

Whether your entry rational is based on your

"FEEL" for a WAG trade or there weren't good signals to begin with or when good singles "FAIL".

03/21/2016...Missed Trades

The opportunities never stop coming...They happen all the time but sometimes you just miss them.

03/15/2016...Read your charts

Utilize the tools that are presented throughout this site...Time frames, Price Action and Signals.

03/08/2016...Avoid Unforced Errors

There are alway going to be better trades presented.

03/04/2016...Trade what you see

Often you can spot a pattern on a higher time frame chart that can be used as a heads-up

for a good trade opportunity. On the left, the 4 minute chart had formed a pennant on a pole.

Place your order entry using the signals that may be firing on the lower time frame trade chart.

The two right hand charts document the possible results.

for a good trade opportunity. On the left, the 4 minute chart had formed a pennant on a pole.

Place your order entry using the signals that may be firing on the lower time frame trade chart.

The two right hand charts document the possible results.

03/01/2016... MT or MAC Trend

Otherwise known as the MACD EMA direction, it lags price action markedly when compared to the faster reactions

of the TRIX and MACD histograms. Even so it can be a good entry signal and it helps you stay in a position once taken.

This set of charts documents a reversal early in the new session. Price Action is P/A no matter what time it is.

02/23/2016...ENTRY SIGNAL hierarchy

Some signals consistently work better than others.

TODAY IS A 2B-DAY

OR IS IT A HOOKER'S PAYDAY?

EVERYDAY IS PAYDAY...

Whether it's Divergence, MT Slings, 2B's or all of them combined,

OR IS IT A HOOKER'S PAYDAY?

The session ended on a BZ 2B reversal near the END OF DAY

(although it faded into the close)

EVERYDAY IS PAYDAY...

Whether it's Divergence, MT Slings, 2B's or all of them combined,

02/22/2016...1 Gain pays for 2 Stops

In the long term, discretionary trading is all about the numbers...What's your total trading Win/Loss ratio? Whats your average Ticks Won vs Ticks Lost per trade? etc, etc, etc

Ignoring your statistics will lead you to ruin.

02/21/2016...Nice longer term 2B

Shaping up as a perfect 2B Dragon...A measured move would put it above the BZ area...

02/18/2016...Waiting can Pay

Take the few moments it takes to scan your other charts before acting on impulse...

In the scenario above, it made only a minor 1 tick difference to the eventual entry level...

Had I not changed my order, my lower bracket would have been triggered - stopped before it popped.In the scenario above, it made only a minor 1 tick difference to the eventual entry level...

Often the higher time frames will cause you re-think a trade...for much better results.

In this case, instead of a $26 loss I made an $84 gain (after commissions)

The EMA lines are considered 'trend' following indicators...the histograms can be used as signal generating oscillators

Having the histos in with price makes divergences very apparent. Sometimes the MAC gives better signals, sometimes the TRIX.

02/12/2016...Keep it Simple

Pre major market

02/10/2016...2B Dragons

I really like the pattern for calling reversals.Used for long term or short term Price Action projections...

02/01/2016...P/A and Indicator Signals

01/30/2016...Muliple market MAC TREND Signals

01/28/2016...You must be IN to WIN

You never can be certain which trades will win big.

Perfect signals happen : 3xD below the TL, MT Slingshots that also show the MOFs.

01/25/2016...Price Action PACE

Major differences exist between TIME based and TICK based charts...

Differences can be especially noticeable when market activity or PACE increases :

Price bars often lengthen on TIME based charts as activity increases...but not always!

Time based charts may not reflect rising activity levels...

The rate that new bars print and the number of bars that print always increase

with TICK based charts whenever PACE rises.

Differences can be especially noticeable when market activity or PACE increases :

Price bars often lengthen on TIME based charts as activity increases...but not always!

Time based charts may not reflect rising activity levels...

The rate that new bars print and the number of bars that print always increase

with TICK based charts whenever PACE rises.

01/22/2016...What I try to achieve...

The example below shows a trade possibility that really did not have great signals firing.

There was the possibility of an MT SLING to propel price upwards. The center chart is how my T-Mode charts

are displayed on the layout. All the yellow and lime text annotations were added afterwards using MS Paint.

are displayed on the layout. All the yellow and lime text annotations were added afterwards using MS Paint.

01/18/2016...Bits and Pieces at a time

Scalping : take Bits and Pieces at a time from the market applies to profit taking

BUT

it also comes into play for limiting the damage done to the bottom line from the inevitable STOP losses.

01/10/2016...3XD Dip-and-Rip

THREE INDICATOR DIVERGENCE...

These charts were 'snapped' on different days, taken at different times of the day and are of different markets.

3XD shows up using either TIME or TICK based charts. They illustrate the power of 3XD reversals on very short term and longer term charts...

On the left is a 60 tick-per-bar per bar chart of the YM ... a 300 tick-per-candle chart of the RUT is on the right.

Similar three indicator divergence signals show at the lows on both charts. The RUT printed an MT SLING after breaking the trend line.

I'm naming the entire pattern on the right hand chart a Dip-and-RIP Runner because of the extended move afterwards.

01/07/2016...TIME vs TICK based charts

The two charts below cover the same session for the RUT E-mini. Although their price action shapes are similar

there are many obvious and subtle differences to be aware of between time based and tick based charting.

12/31/2015...Reminder:

12/29/2015...WMA-MACD as a Signal

I use two Weighted Moving Averages on most of my chart templates. One is a 30 period WMA that prints in the price pane.

The other is 4 period WMA in the study pane (the white line) which is applied to the faster MACD EMA ...

The red and lime line is the standard Signal MACD EMA.

The 4 point white star prints whenever the faster WMA-MACD EMA turns from down to up.

The other is 4 period WMA in the study pane (the white line) which is applied to the faster MACD EMA ...

The red and lime line is the standard Signal MACD EMA.

The 4 point white star prints whenever the faster WMA-MACD EMA turns from down to up.

12/21/2015...P/A, Signals and Time Frames

12/18/2015...Picture Perfect Pattern

2B Dragon Price Action Pattern with three indicator divergence Signals

12/14/2015...4 chart sets covering 2 hours

What goes down must go up...and vis-a-versa of course12/08/2015...nice day in the RUT

The DIV MT SLING

Another 2B Dragon 3xD DIV with a Re-Test entry...letting price come back to you

12/04/2015...Time Frames and Signals

First comes the divergence signals suggesting a potential for a trend change...take an initial entry

Continue to watch for signals that confirm the establishment of the new trend...

Add to initial position or initiate an entry if you missed the divergences

12/03/2015...There will be days like this...

When you are afraid to trade - don't - just get over it ASAP because the 'Coulda-Shoulda-Woulda's

can easily put you into a funk-slump...Remind yourself that there will always be another good trade to take.

This one Coulda-Shoulda-Woulda returned $700

This one Coulda-Shoulda-Woulda returned $700

...Standard Operating Procedure...

******12/01/2015*******

The market vehicle you choose to trade does not matter -- Repetition of method does

******11/26/2015*******

Watch multiple Time frames for Signal Divergences before Price breaks out above the Trend Line.

11/24/2015...Time vs Tick charts

Viewing both can be useful for making entry decisions...

11/23/2015...Divergence, Signals and Time Frames

11/21/2015...Late to the Party trades...

The center narrower study pane showcases what I call MAC Trend Turns. The faster MACD EMA printsa white diamond and the Signal MACD EMA prints a smaller lime triangle when either begins to turn up...

They ARE NOT used for early initial entries - they lag too far behind faster reacting oscillators (STO & Histo).

I use them mainly to add to a well filled early entry position. But they can also be used when a good

initial entry point was 'missed'. They help with the decision whether to enter a late to the party order.

Relationships between P/A and signals are almost always different between chart time frames

but often there will be a 'heads up' on one that can alert you to look at the others for entry opportunities.

11/19/2015...QuoteTracker fans...

Those of you who are familiar with QT will be glad to know the Medveds are developing a replacement.

Medved Trader (MT) beta is available NOW for free. It already supports a variety of brokers

as well as independent vender's data feeds.

It is a beautiful program and incorporates much of what you'll recognize from QT.

You can expect the same level of features, support and dedication that Jerry and Mike always provided.

I have been trying it out using Yahoo Finance's free data feed...Track stocks, ETFs and Indices

(including back fill) - Daily & intraday...For futures, Yahoo provides the Continuous Contract symbols...

I'm still getting to know where everything is in MT and am enjoying many of the new features...

11/19/2015...Better Entries

Price Action, Time Frames and Signals

Other zero-ing in comparisons

11/17/2015...MACD and Stochastic

Ever wonder why so many traders use these two indicators?

Because they work.

For short term scalping I like Tick based. They show much more at a glance...and earlier

(another new template, separate study pane for some of the Show Case indicators)

I still need to do some 'tweaking', changing when the MACD EMA directional Show Cases print in the study...

Like most indicators they tend to print a bit late - less so as you move toward shorter time frames.

IMO, the MACD is a terrific tool - a combination of an oscillator (the histogram) and a trend follower (the EMAs)...

I use the standard MACD settings (12,9,26) and have not been able to improve upon them by substituting

with different length periods. I also use a relatively fast stochastic (5,4,3 sma) displaying only the Slow D line.

11/16/2015...AH trading is very SLOW

The same methods and signals can be used as those used during the major market hours.

Market action is pretty much the same, but it usually takes a lot more time per trade.

11/12/2015...Trade Management is KEY

Sometimes even with good signals you loose. Three of four trades got stopped-out...

Managing the losses helps to eliminate REALLY BAD days.

On the other hand, just using a wider stop on the first entry would have resulted in a nice gain...

BUT you never can tell when a massive drop will take you with it...I hate when that happens.

11/12/2015... Remember the Classic Patterns

11/11/2015...Keep it Simple

11/09/2015...Price Action - patterns and signals

11/06/2015... Anticipating a reversal (at some point)

When you see potential reversal patterns or well defined signals on the longer term

"'Spotter" charts, the following methodology often saves you from getting some FILLs-and-STOPs...

Using Trailing Buy-Stop orders can keep you out if you misjudge the strength if the current down trend.

11/05/2015...The MT SLING pattern set up

On a very short term 22 tick chart shortly after the majors opened...

And a 2B MT SLING pattern set up on minute based charts near noon time...

11/04/2015...Why I don't short...

My methodologies work best for taking longs.

▲ In general it takes more "effort" for prices to move up than down ▲

▲...It took over a half hour to move up and only 12 minutes to erase that effort...▲

10/30/2015...The never ending repetition of signals and patterns

10/30/2015 - More TEST trades over a 30 minute period

What was learned -- wait for confirming signals

10/29/2015...Test trades can help get your "FEEL" up to speed

Here's four examples from the pre-major market hours...they are back-to-back, spanning 40 minutes...

The left hand charts show the order entry, the right hand show the results.

What was learned -- decent signals and patterns were working but they did not produce great runs.

10/28/2015...FED minutes today...

10/27/2015...Price Oscillations are ALWAYS happening

Take out bits and pieces at a time

Always be aware of price action until it becomes second nature...

Price Oscillations are ALWAYS happening

10/21/2015...Buy-Stop entry technique

Signals were OK but the market just wasn't ready to oblige.But just a short time later the market served up a beautiful set up...

10/19/2015...ya hast to take some chances...

Better to do so when it can't hurt you too much.

10/13/2015...MT aka MACD ema crossovers

In general, they are VERY reliable reversal signals on any time frame

10/10/2015...New MT templates...

Generally I find that having too many indicators on my charts usually obscures the price action.

But here's a couple of possibilities I'm going to try just for grins...I added the same MACD stuff to the price pane that were

already present in the study. I'll try them out on differing time frames and may end up running just the MT diamonds.

The shorter the time frame used, the earlier the signals print - thus the more accurate they become.

10/08/2015..."Late" to enter MT signals

Waiting for a reversal to consolidate very often offers good entry opportunities

Combining differing time frames can get you in early - add to your position at the "Late" signals

There are times when the longer term 'Spotter' chart doesn't tell you very much -

so all that you use is the trade chart for entry rationalizations.

10/07/2015...Knowing when to stand aside

Good price action can and does fail to produce reversals of substance...knowing when

they are failing is very difficult to determine at times....that's what stops are for...

You snooze you lose

Was not gonna get caught napping this time !

10/06/2015...Time based vs Tick charting

Time vs Tick chart signals for taking trades

10/02/2015...Simple but elegant

9/30/2015...Relationships review

10/01/2014

9/29/2015...Resurrecting the CCL bar coloring

Have previously used 3 Consecutive Closing Lows as an entry signal on T-Mode charts...

Now I'm trying out CCL on longer term "Spotter" charts.

Will see how well they work as a heads up...i.e. to start looking for entry signals on the T-Mode charts...

A total of three Custom Coloring indicators are added to the chart template, applied to the candlesticks.

For the Red Neg Price candlesticks the condition formula used is open>close (includes the candle body)

The 3rd CCL formula is close<close[1]&close[1]<close[2]&close[2]<close[3] (Lime outline and shadows)

For the instances where a 4th, 5th or more CCL candlestick print, the following formula was added:

close<close[1]&close[1]<close[2]&close[2]<close[3]&close[3]<close[4] (white outline and shadows)

10/1/2015...CCL on the "Spotter" chart + signals on the T-Mode

9/29/2015...Remain Actively Involved

Be aware when price is taking too long to move in the direction you had anticipated...

...even when good signals continue to print...

9/27/2015...Be attentive

Below is the same trade as the above but a few minutes later...a coulda-shoulda-woulda look...

Tight stops when scalping are necessary but you also must weather the ones that get away...

Just continue to remember : There will always be another trade.

9/24/2015...Be FlexibleSometimes the 'better' entry patterns and signals will be present on the Shorter term...

Sometimes the 'better' entry patterns and signals will be present on the Longer term...

Sometimes good entry patterns and signals will be present on both the Shorter and Longer term

9/23/2015...Simple signals

Here's an example using a standard out-of-the-box MACD indicator for scalping bits and pieces on a 3 minute chart...

DIV + MAC X + TLB on multiple time frames

Another multiple time frame opportunity - entry chart on right

9/17/2015...Same-'ol-same-'ol patterns and signals

09/15/2015...Some more rules to keep in mind

Don't-be-greedy - most trades won't run very much

Don't-be-greedy II ...but-but...NO BUTs about it

Don't-be-greedy III ... one more if-and-or-BUT

The next example may get you thinking you aught to loosen up your stops to take larger gains...

That is a type of Coulda-Shoulda-Woulda mind game to be avoided. On the other hand...

If you have already racked up some nice trades for the day

then letting your winners run can be a reasonable tactic.

9/14/2015... Short term signal rational

I 'normally' concentrate on longer term chart patterns and signals for spotting potential

reversal areas and then look to the shorter term charts for confirming rational for entries...

And although I always have several longer term minute based charts open, in this case the very short term

45 tick T-Mode chart was used by itself for making the decision to buy...

9/14/2015...Chart preferences

You can adjust time based and tick based charts to reflect the same price action...

Be aware that the indicators will show only similar partterns between the two types.

Slightly shorter term of the above charts

09/11/2015...Keep it simple

09/09/2015...It can be frustrating at times

But remember there will always be another trade

09/08/2015...Some of the charts I use:

09/04/2015...Price Action across markets

08/28/2015...Signals across time frames

Three indicator divergence signals (3xD)...below the trend line...on multiple time frames...for low risk entries

08/27/2015...Minimal Distractions

Testing this template as my T-Mode chart set up. Removed non-essentials such as Bid/Ask flags and Time/Price scales

in order to better focus on Price Action to Indicator relationships.

Here is an example of the new template in action...although I missed this trade you can see how it works...

Below shows the T-Mode charts I use for the YM, NQ and RUT...For the ES I use 480 tick, 240 tick and 120 tick chart settings.

08/25/2015...Missed then filled

Keep watching even if you miss getting a fill - opportunities often come back-to-back...

08/18/2015 - Fast markets

Very difficult to get orders in at the level you'd like near the major market open.

08/17/2015 - Time frames and chart width

I am continually making adjustments in order to see what I need to see.

08/04/2015...Money on the floor

07/28/2015...2B Dragon bottom

07/27/2015...Money on the Floor

Combined with good signals, MOF's are very high percentage trades.

Note that the same signals often print simultaneously on different markets.

...and often the 'quality' and quantity of signals varies at reversals in different markets...

Other caveats:

Every Price Action Reversal is not necessarily preceded by good signals...

Good signals do not automatically 'guarantee' a reversal is forth coming...

07/26/2015...Tick vs Time based charts

I watch both types but like tick charts for P/A patterns...

07/21/2015...Spotter chart - Reversals Rule

One the advantages of watching multiple time frame charts is the increased number of signals produced...

Some days a discretionary trader will key on the longer term charts looking for divergences or oversold conditions

and then look at the shorter term charts for additional entry rationalizations.

In the charts below, a long tail printed and STO was O/S on the 3 minute chart...Without the 3 min signals

the mediocre signals on the shorter term charts may not have been good enough to take for an entry...

07/17/2015...Combine different stuff - increase the odds

Own the tools that are presented throughout this blog for choosing when to go for it...

07/10/2015...Remember to keep it simple

...Patterns that Constantly Repeat...

07/07/2015...Bottom patterns

07/02/2015...Same 'ol same 'ol

Use the stuff presented on this blog...day in, day out

Sometimes it's better to let "feel" influence your decisions - especially when the entry signals were not that great.

7/01/2015...Spotting opportunities

06/26/2015...Missed opportunities

Don't sweat missed entries

There will always be another trade opportunity.

06/19/2015...Signals and Time Frames

06/07/2015...Testing TIME based charts

30 second...1 minute...3 minute

06/05/2015...Keep your winners by using Stops

06/02/2015...Don't sweat missed entries

There will always be another trade opportunity.

There are times that you do not or cannot see good signals in order to take an entry and sometimes you are late to react to signals.

Or you may decide to enter your order below the current price in an attempt to get a better fill on a retest...

Always bear in mind that there are many different signals

Sometimes you notice it's a BZ day...

5/29/2015...Get into training; to see Signals

Study Price Action; learn patterns and signals...train until they become second nature to you.

05/19/2015...STO pattern

It only takes a few bars sometimes...

05/22/2015.... Many more STO trade charts/examples are posted on this iHub message board ...

05/29/2015...Perfect 3xD

Different day, different symbol, same signals...equally good results.

5/05/2015...Signals and Time Frames

Often the higher time frame will give the better signals.

5/03/2015...The MAC d

30 second...1 minute...3 minute

The pre-major market hours can be slow...

06/05/2015...Keep your winners by using Stops

06/02/2015...Don't sweat missed entries

There will always be another trade opportunity.

There are times that you do not or cannot see good signals in order to take an entry and sometimes you are late to react to signals.

Or you may decide to enter your order below the current price in an attempt to get a better fill on a retest...

Always bear in mind that there are many different signals

Sometimes you notice it's a BZ day...

5/29/2015...Get into training; to see Signals

Study Price Action; learn patterns and signals...train until they become second nature to you.

05/19/2015...STO pattern

It only takes a few bars sometimes...

05/22/2015.... Many more STO trade charts/examples are posted on this iHub message board ...

05/29/2015...Perfect 3xD

Different day, different symbol, same signals...equally good results.

Different day, different symbol, different signals...equally good results.

Often the higher time frame will give the better signals.

5/03/2015...The MAC d

Hard to beat the standard MAC D ... as a trading tool.

Its considered to be a indicator of price trend (esp. it's EMAs) but when combined with

it's histograms it can be an oscillator, IMO...the histo is particularly good for identifying divergences:

The Acceleration/Deceleration Oscillator is also pretty good when shown as a histogram:

Here a comparison of several popular oscillators (shown as histograms instead of lines) against the same price action....

5/01/2015...CCL setting up the FLO

Combining two trading patterns

Three Consecutive Closing Lows (CCL) and the 1st Monday of the month (FLO)

The NQ is printing CCL's as we approach the ES entry for May's 1st Monday...

My idea is to take the ES trade at the session open Sunday night...IF the NQ does indeed reverse...

IF the NQ does fill at Thursday's closing price, I'll assume that its leading again and anticipate the ES following that lead...

04/30/2015...Can't play them all

04/21/2015...Always keep the basics in mind

Simple...works

This pattern repeats continually

04/16/2015...Time Frames, Signals and patterns

Divergent reversal followed by a 'perfect' measured move

04/14/2015...TREND INDICATOR - MT or MACD EMAs

4/02/2015...Multiple Time Frames & Signals

Simple to see but difficult to discipline yourself to wait for it to happen...

3/27/2015... Putting all together

Combine many aspects of the techniques described throughout this blog to enhance your trade results...

Use Price Action, Trend Lines, Indicator Signals and Multiple Time Frames to trade Patterns that continually repeat.

03/27/2014...Failed Reversal Signals

They usually let you know almost immediately...

03/25/2015...'Fair' or 'good' signals don't always precede winning trades.

03/18/2015 Tails as Tells

03/13/2015 ... Perspective

Use Price Action, Trend Lines, Indicator Signals and Multiple Time Frames to trade Patterns that continually repeat.

03/27/2014...Failed Reversal Signals

They usually let you know almost immediately...

03/25/2015...'Fair' or 'good' signals don't always precede winning trades.

03/18/2015 Tails as Tells

03/13/2015 ... Perspective

Increase your odds for successful trades using multiple time frames

Hammers can be great signals...

Watching the longer term 'spotter' chart for bullish set ups increases the odds

when entering on shorter term signals and patterns.

Oversold Stochastic can be a stand-alone signal for pulling the trigger

Hammering out a low...

Hammers are reversal candlesticks. They print frequently and offer well defined entry and stop levels.

Reversed the TRIXh and MACD positions on the chart and combined other attributes

02/24/2015 ... 3 Consecutive Closing Lows

More examples of the method working on lower time frames...I refined the chart template to show just the 3rd CCL bar.

01/25/2015 ... 3 Consecutive Closing Lows Template

So far it seems to work fairly well to identify multiple consecutive lower closes.

01/26/2015 -- Incorporated 3 CCL signals into the existing 'trial' template...

01/27/2015 -- Removed the Show Case indicators...have not yet figured out how to stop

the 4th, 5th (etc) CCL shapes from appearing after the 3rd CCL bar.

(note - the yellow arrows and lines were added using MS Paint)

01/27/2015 -- CCL using Colorizing only, OHLC or HLC bars vs Candlesticks...

The 3rd CCL was colored RED and made thicker.

When using HLC bars, Positive and Negative bars are WHITE except for the Thicker, RED 3rd CCL bar...

The 4th CCL, 5th CCL etc. bars will be RED but will be a 'normal' thickness.

With Candlestick charts, the outlines are white...Positive candles are filled lime, Negative candles are filled BLACK to appear hollow.

The thicker 3rd CCL bar is outlined and filled with RED while 4th,5th etc. CCL bars are 'normal thickness.

They get outlined in red and are filled with BLACK...

I also have a similar template that will color the CCL bars that follow the 3rd CCL bar WHITE.

But when switching it to candlesticks it fills those bodies WHITE, making the chart a bit too confusing

because you have to remember that red, black and white bodied sticks ALL mean negative sticks...

01/19/2015 ... Trial Template update

Added an add'l indicator to the stochastic

Simple two chart counter trend scalping

The Spotter chart's stochastic is oversold and the Entry chart showed divergences...

(in the MACD histogram, the MACD EMAs, the TRIX histogram and the stochastic)

These are all signals suggesting a trend change was about to happen...BUY !

10:14 - Enter a market order any where below the trend line or a buy-stop placed at 1982

(stop order would be placed above the current price bar, where price would break above the trend line)

10:16 - A new higher high printed before retracing back to the trend line break-out area

10:17 - The first higher low printed and formed a Money-on-the-Floor pattern which also set up the stochastic's

Continuation Slingshot pattern...All of these signals confirm that the new up trend has indeed begun.

Continuation Slingshot pattern...All of these signals confirm that the new up trend has indeed begun.

This is a good place to add contracts to the existing position...

A few more examples of the method...

The use of trailing buy stops can keep you out of a position when your rationale for entering a position

becomes moot...thus saving you from having to rely on your sell stop to limit a loss.

01/12/2015 ... Trial Template update

I changed the MACD settings on all g and h series templates:

Applied a 4 period Weighted Moving Average to the 'fast' MACD ema to smooth it out a bit - the 'signal' ema

is still at the standard setting...Am still getting used to the new templates but like them so far...

is still at the standard setting...Am still getting used to the new templates but like them so far...

The ApexTrader software is great for customizing charts and trying new ideas.

I moved the MACD, MACDh and lime MT dots to the price pane and eliminated the WMA...

I moved the MACD, MACDh and lime MT dots to the price pane and eliminated the WMA...

A slightly faster TRIX (4) with lime slope coloring is in with the Stochastic.

The idea was to see the MACD EMA cross-overs and their trend clearer. The MACDh multiplier

was cut down from 2 to 1 and given fatter negative bars so that it's slope

was cut down from 2 to 1 and given fatter negative bars so that it's slope

could still be seen when the price bars are over it.

Hopefully the indicator will stay centered in the price pane so I won't have to constantly adjust its position.

The stochastic still has the fatter orange coloring when it's heavily oversold or overbought.

Will see if these templates turn out to make the charts too 'busy' ... (I may try adding 2 differing TRIX EMA lines too)...

At this first application I can clearly see the price action's double bottom AND

the divergences in the MACD, the MACDh, the STO and the TRIXh ...( 4xD ?)

Hopefully the indicator will stay centered in the price pane so I won't have to constantly adjust its position.

The stochastic still has the fatter orange coloring when it's heavily oversold or overbought.

Will see if these templates turn out to make the charts too 'busy' ... (I may try adding 2 differing TRIX EMA lines too)...

At this first application I can clearly see the price action's double bottom AND

the divergences in the MACD, the MACDh, the STO and the TRIXh ...( 4xD ?)

T-Mode charts on monitor 6 - added horizontal grid lines on the shorter time frame and a horizontal 'Last' line.

Made some other minor changes and saved a 2nd g1 template...usually displayed as shown on the RH chart set.

The longer time frame chart has 'On Top' selected to cover the T-Mode column of the shorter TF.

Made some other minor changes and saved a 2nd g1 template...usually displayed as shown on the RH chart set.

The longer time frame chart has 'On Top' selected to cover the T-Mode column of the shorter TF.

Also saved a session chart template for candlesticks...

01/06/2014...3 consecutive down bars

A method for going long suggested today by surfcat on iHub's board...

Buy at the closing price of 2nd consecutive down bar once the 3rd consecutive down bar closes.

One reason it appeals to me is that it can keep you out

Buy at the closing price of 2nd consecutive down bar once the 3rd consecutive down bar closes.

One reason it appeals to me is that it can keep you out

if price does not react in the way you anticipate...saving you a stop-loss to protect from further downside.

Here's the method applied using the longer term chart's signals to confirm an entry on the shorter...

(Note on the 480 tick chart how the entry for the 3 consecutive lows (that became 4) would not have been filled...)

(Note on the 480 tick chart how the entry for the 3 consecutive lows (that became 4) would not have been filled...)

Divergences announced these reversals in the ES and NQ...The ES printed a perfect 2B Dragon bottom as well

Same pattern but without divergences in the YM and RUT...they were very close to doing so too...

( by my definition , prices must make an equal or a lower low while the indicators do the opposite to be divergence)

Pretty basic stuff here, lest we forget...

01/02/2015...Patterns

The 2B pattern...they work with surprising frequency......a scalp example before

and after

It developed into a "perfect" 2B Dragon pattern

Holiday week, early morning on the 3 minute chart...it took nearly an hour to develop but it shows that

12/27/2014...2 vs 1 study

The same charts but slightly differing views of the divergent 2B

12/22/2014...What's for lunch?

Tuesday's special is 3-minute RUT...Divergence served on a triple bottom platterWednesday's Lunch Special...Divergent multi-bottom Over/Under glass...

12/17/2014...Chart watching

MACD and Stochastic...the most commonly used indicators. They have been around forever because they work so well.

I use a standard MACD (12,9,26) for its trending attributes along with its histogram, which I consider to be a timing oscillator.

The stochastic is also an oscillator. I display just the SlowD (5,4,3 Sma). The slowK color is set to transparent...

The TRIX histogram in the price pane works very similarly to (and confirms) the MACD histogram.

Time frames and signals for entry...

I like to enter trades when the longer term chart's stochastic is deep in oversold territory

and the shorter term T-Mode charts are firing off good signals.

In and out in 2 minutes...Sold a bit too early but am satisfied with the return.

Entry chart - after the stochastic entered O/S on the 5 minute chart above...

Exit chart - a quick $100 per contract scalp before the majors opened...

Exit chart - a quick $100 per contract scalp before the majors opened...

Had to correct some of the arrows/dates - most noticeably the October turns...

12/07/2014...1st and Last Mondays plus the Friday before OEX

An interesting strategy based on Larry William's work on seasonality and repeating situations.

The idea is to go long the S&P futures on the first and last Mondays of the month as well taking longs on Fridays before OEX.

Monday entries - add 10% of the previous Friday's range to the open price

Friday entries - buy just before the close

Larry's work suggests these have proven to be particularly good entry times for longs, historically.

12/14/2014 - Corrected the arrow placements for October...

12/04/2014...The pre-market

Interesting movement before the majors opened...

Shorter term patterns and signals are easier to see and happen with more frequency...

Allowing more low risk trades with less time exposure to volatile, uncertain markets...

12/02/2014...REVERSALS RULE !

11/25/2014...Clear signals - not so clear

Some days good signals show on the longer time frames that are not so clear on the shorter...

11/21/2014...It's not easy

There are times when good signals are firing but price doesn't cooperate...like there's a delayed reaction...