Utilize BULL and BEAR ETFs

The chart examples shown are 2X and 3X ETFs but I have also used this method with individual equities

The chart examples shown are 2X and 3X ETFs but I have also used this method with individual equities

that I followed closely. But I found I missed many opportunities because:

1) It's too difficult to find stocks whose price action behaved similarly

with that of a major index's price action

with that of a major index's price action

2) Often my broker would not have the shares available for borrowing

in order for me to sell short individual equities

3) I have never liked selling short and am not good at it.

and

in order for me to sell short individual equities

3) I have never liked selling short and am not good at it.

and

4) My methods for trading reversals work better at bottoms than at tops.

I developed this Comparative Trade Scalping method to eliminate the issues described above. The method allows you

to take advantage of price swings in either direction...by taking LONG trades only...

to take advantage of price swings in either direction...by taking LONG trades only...

There are no worries about whether there are shares available for shorting and no extra

fees (on top of margin interest) that are often associated with shorting.

fees (on top of margin interest) that are often associated with shorting.

IF you are completely "In The Zone" you can effectively use a Sell and Reverse method (SAR) with ETF pairs

i.e. sell the Bull ETF to close and buy it's Bear counterpart to open.

Note that you will need to maintain at least $25,000 in your account in order

to avoid the Pattern-Day-Trader restrictions

severely limiting the number of trades you will be able to take in any 4 day period...

Note that you will need to maintain at least $25,000 in your account in order

to avoid the Pattern-Day-Trader restrictions

severely limiting the number of trades you will be able to take in any 4 day period...

Comparative Method and Chart set-up

Click any chart for Slideshow mode...

OR

...for larger chart views, right click on any chart and select "Open in a new window or new tab".

The Methodology:

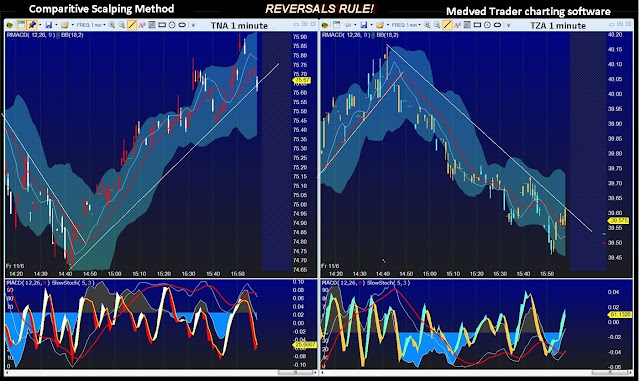

Pair up two charts - one of a Bull ETF and the other of its Bear counterpart...Set them up to be the same size and time frame**...Use the tools described on my other pages to spot potential reversals of the ETF that is currently trending down, looking for possible reversal areas for counter trend long entries...Once you have established a position, study the price action of the other ETF...It should have reversed it's up trend by now... Now begin looking for signals suggesting that it may be about to reverse from down to up...Use those signals to exit your long position in the opposite ETF... and perhaps enter a new long position in this one.Thus you are always taking LONG positions, alternating between the Bull and Bear ETFs.

My trend reversal signals work with greater frequency for spotting reversals of down trends than they (or their inverse)

work for spotting reversals of up trends. Thus the use of two paired ETF charts, one bull and one bear...

While one ETF will be showing a down trend, the other will be showing an up trend...the ETF that is currently

in a down trend is used for spotting the trading signals to:

1) ENTER a new long position in that market

2) EXIT an existing long position in it's counterpart

or

3) SAR - execute both simultaneously

(effectively selling and reversing without shorting).

** This set up is easier when using time based charts. If you use tick charts and switch between markets often, you may find that you will be constantly adjusting the ticks-per-bar of the chart pairs to account for the differing activity levels from day to day, or even hour by hour...

______________________________

Mood Music by Joni Mitchell (Twisted ) for understanding this trading method

The "Rorschach Test" chart

Another way to compare price action between Bull and Bear pairs is to overlay one symbol on the other.

Note the left scale is for TZA and TNA is on the right. The WMA line and the indicator pane is for TNA.

I include this chart only to show the inverse relationship that ETF pairs share...

For trading, it would not work as well as would two separate charts

because there is only one set of study indicators.

I've found that trend days are harder to make entries as there are fewer intraday reversals. This is when "feel" will help out.

If your trading "feel" has been good recently, cancelling or raising the TTO-Stop target-side of the order after the Limit-fill

side is completed in order to try for increased gains can be rewarding. But if you just "feel" lucky and cancel the automatic

TTO-Stop target-side order (or the lower TTO Stop-loss), you may see this action take a bite out of your scalp.

If your trading "feel" has been good recently, cancelling or raising the TTO-Stop target-side of the order after the Limit-fill

side is completed in order to try for increased gains can be rewarding. But if you just "feel" lucky and cancel the automatic

TTO-Stop target-side order (or the lower TTO Stop-loss), you may see this action take a bite out of your scalp.

(TTO orders are also known as Bracket orders)

I like using the ETF's with this method, especially the 2X and 3X. The liquidity is always there and you need not trade large size

to get a good daily return. Slippage is limited on the TTO STOP-LOSS and TTO SELL orders, which are executed as market orders.

to get a good daily return. Slippage is limited on the TTO STOP-LOSS and TTO SELL orders, which are executed as market orders.

I NEVER hold ETF trade scalp positions overnight and rarely trade pre-market or after hours.