Short reviews of the day's market action after the majors close....

-------------------------------------------------------------------

Friday 12/29/2017

Thursday 12/28/2017

Wednesday 12/27/2017

Tuesday 12/26/2017

Friday 12/22/2017

Thursday 12/21/2017

Very low volume flags forming.

Wednesday 12/20/2017

Tax bill passes

Closing spinners on low volume, down but little change

Tuesday 12/19/2017

Tax vote - both houses

Monday 12/18/2017

Friday 12/15/2017

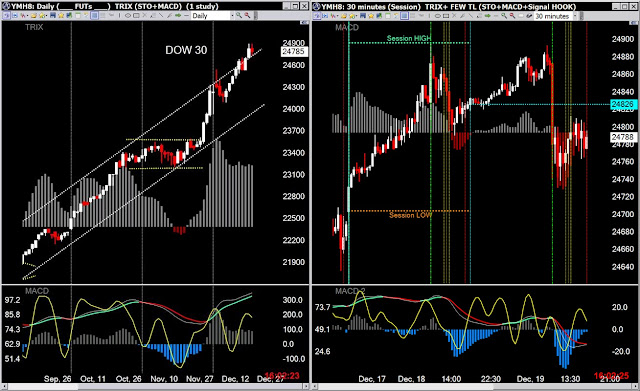

YM daily closing ATH with a stick sandwich

ATH's for both the ES and the NQ , breaking out nicely to the upside.

Friday 12/15/2017

The December E-Mini Equity Index futures and options expired today at 8:30 am CT.

Thursday 12/14/2017

Wednesday 12/13/2017

Tuesday 12/12/2017

Monday 12/11/2017

YM&ES ATH's...what else is new?

Friday 12/8/2017

All time closing highs for the YM and ES

Thursday 12/07/2017

Wednesday 12/6/2017

Tuesday 12/5/2017

Monday 12/4/2017

Friday 12/01/2017

Another wide range session -- very high volume sell off and recover.

Thursday 11/30/2017

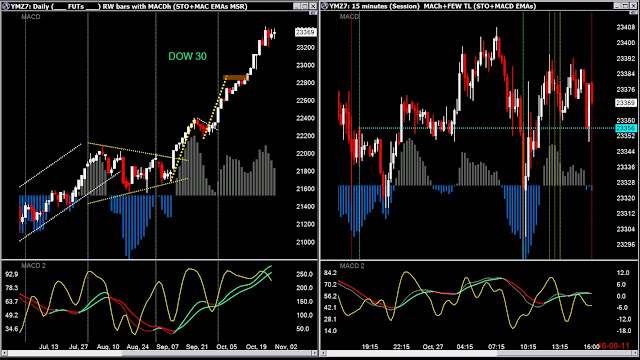

Major up moves to ATHs in the YM and ES on big volume -- blow off top?

Recovery to the break-down area

Wednesday 11/29/2017

Tuesday 11/28/2017

Broader markets up big-ly, Nasdaq not so much

Monday 11/27/2017

Friday 11/24/2017...1:15 close?

Thursday 11/23/2017 - Thanksgiving session

Wednesday 11/22/2017

Tuesday 11/21/2017

All time closing highs

Monday 11/20/2017

Friday 11/17/2017

Thursday 11/16/2017

Wednesday 11/15/2017

Monday 11/13/2017

Friday 11/10/2017

Thursday 11/9/2017

Major volume day with large ranges...retracing most of the drops by the close

YM retrace of the drop - Brach Zone Fibonacci

Wednesday 11/8/2017

NQ ATH, ES close behind, YM UNCH...lower volume

Tuesday 11/07/2017

Today's Doji-Spinners suggest a pause while markets think about where we go.

Monday 11/06/2017

Friday 11/03/2017

Thursday 11/02/2017

Wednesday 11/01/2017

Prices stabbing the underbelly of ATH'S but closing below.

Tuesday 10/31/2017

Monday 10/30/2017

Friday 10/27/2017

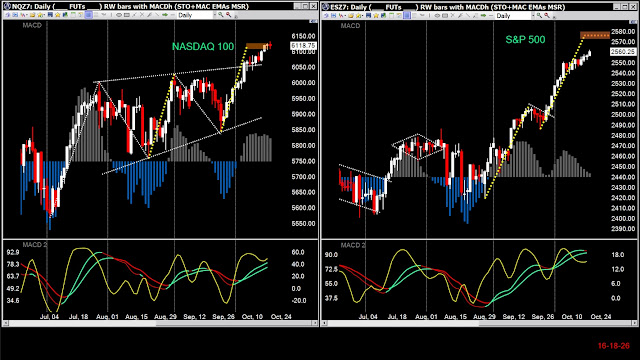

Impressive move for the NASDAQ

Thursday 10/26/2017

Wednesday 10/25/2017

High volume sell off...

Tuesday 10/24/2017

Full steam ahead for the DJIA, not so much for the ES+NQ

Monday 10/23/2017

Friday 10/20/2017

Thursday 10/19/2017

Volume returned and brought a big recovery from the overnight swoon

Wednesday 10/18/2017

Tuesday 10/17/2017

Lower volume but ATHs

Monday 10/16/2017

Very low volume NR 7 pattern completed today although the YM & NQ into ATH territory..

Friday 10/13/2017

Trump announces no deal with Iran - sends it to the cowards in Congress

Thursday 10/12/2017

Very low volume and narrow ranges

Wednesday 10/11/2017

Closing at ATHs

Tuesday 10/10/2017

Monday 10/09/2017

Low volume - small movements

Friday 10/06/2017

Thursday 10/05/2017

Closing at ATHs...again...still...

Wednesday 10/04/2017

Tuesday 10/03/2017

Monday 10/02/2017

ATHs for the YM and ES with the NQ UNCH...

Friday 09/29/2017

Thursday 09/28/2017

Continuing talk about PDT's tax plan

YM breaking out of a small flag-on-a-pole pattern...

ES broke out yesterday and continued up today ... the NQ bouncing back

after testing the lower line support of its rising wedge

Wednesday 09/27/2017

Tuesday 09/26/2017

Monday 09/25/2017

Friday 9/22/2017

Two weeks of just about continual straight up for the DJI and S&P...

The Nasdaq is rolling over within a large wedge

Thursday 09/21/2017

Wednesday 09/20/2017

Tuesday 09/19/2017

Diminished volume, range and change...

Monday 09/18/2017

Friday 09/15/2017

ATHs for the ES &YM

YM complete session and MMO session

Thursday 09/14/2017

Wednesday 09/13/2017

Tuesday 09-12-2017

Rollover to new contract

Monday 09/11/2017

Remembering 911

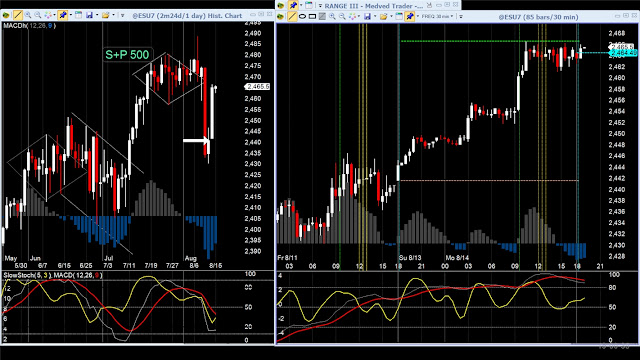

The ES closing in ATH territory

Friday 09/08/2017

Big down day for the NQ

Thursday 09/07/2017

Wednesday 09/06/2017

Tuesday 09/05/2017

Wide ranges...large volume on the sell offs.

Friday 09/01/2017

Weaker volume, narrow ranges and little change.

Thursday 08/31/2017

NQ reaching ATH on big percentage move...3 white soldiers.

Nice uptrend for the ES too & an increase in volume.

YM up but lagging a bit.

Wednesday 08/30/2017

Significant gain for the NQ, the ES up moderately and the YM UNCH

Tuesday 08/29/2017

Great to see the spirit of partnership that exemplifies Americans in dealing with the tragic events in Texas

Strong recovery on higher volume, closing near the highs

Overnight divergence set up the day

Monday 08/28/2017

Friday 08/25/2017

Thursday 08/24/2017

Long legged spinners closing UNCH.

Wednesday 08/23/2017

Tuesday 08/22/2017

Yesterday's long lower tails 'announced' today's recovery.

Monday 08/21/2017

Friday 08/18/2017

Thursday 08/17/2017

↓↓↓ ↓↓↓ ↓↓↓ ↓↓↓ ↓↓↓

Wednesday 08/16/2017

More indecisive spinners

Tuesday 08/15/2017

Lower volume doji

Monday 08/14/2017

Strong snap backs (...as if Thursday never happened)

Friday 08/11/2017

Thursday 08/10/2017

Large ranges, major percentage drops on big volume...

Wednesday 08/09/2017

Wide ranges, long lower tail recoveries late in the day - - volume up.

Tuesday 08/08/2017

Wide ranges down and volume returned...

Monday 08/07/2017

Extreme low volume, about half the usual...

Friday 08/04/2017

YM was into new highs all week while NQ and ES lagged sideways within diamond patterns.

Thursday 08/03/2017

Wednesday 08/02/2017

YM closing refusing to drop, closing lightly up...

The ES and NQ closing slightly down but with long lower reversal tails.

Wild day starting at the MMO, VOL up too. Not recovering as much relative to the other indices.

Tuesday 08/01/2017

Wide range sticks to close the session.

-------------------------------------------------------------------

----------------------------July---------------------------

Monday 07/31/2017

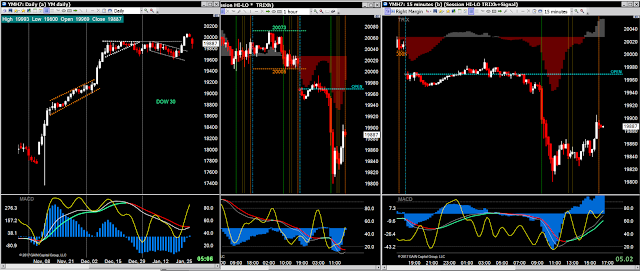

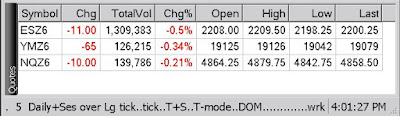

YM up strong, NQ down and ES pretty much UNCH...EOM positioning?

Friday 07/28/2017

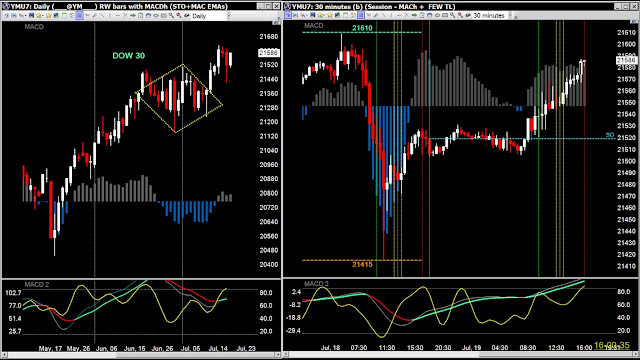

DOW 30 (YM) ATH at the major market close.

Thursday 07/27/2017

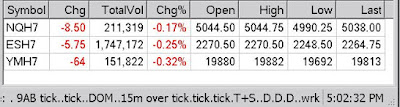

Wide ranges in the NQ and ES closing down while the YM kept driving up

Volume kicked up a notch...

Wednesday 07/26/2017

DJI leading, closing at ATH...volume down a bit.

Tuesday 07/25/2017

Monday 07/24/2017...Low volume

Friday 07/21/2017

Thursday 07/20/2017

Wednesday 07/19/2017

ATH for the ES & NQ on low volume

Tuesday 07/18/2017

Monday 07/17/2017

Friday 07/14/2017

Strong week, ATH's but on lower volume.

Thursday 07/13/2017

New closing highs again...low volume again...

Wednesday 07/12/2017

YM and S&P breakouts - on lowish volume

Tuesday 07/11/2017

Monday 07/10/2017

Friday 07/07/2017

Thursday 07/06/2017

Wednesday 07/05/2017

Tuesday 07/04/2017

4th of July holiday shortened session

Monday 07/03/2017

4th of July holiday shortened session

Friday 06/30/2017

Friday morning 06/30/2017

Thursday 06/29/2017

Big volume with wide ranges ...

Divergent bottom reversal, retraced 50% of the plunge

Stick sandwiches

Wednesday 06/28/2017

Volume up a bit...

Tuesday 06/27/2017

Monday 06/26/2017

Friday 06/23/2017

Thursday 06/22/2017

Wednesday 06/21/2017

The Techs powered up strong while the big guys sold off

Tuesday 06/20/2017

Monday 06/19/2017

Friday 06/16/2017

Thursday 06/15/2017

Very low volume sessions, due to contract rollover.

Not much change, pretty wide ranges and long lower tails

Wednesday 6/14/2017

Very low volume for a FED minutes day

Tuesday 6/13/2017

ATHs for the YM and ES

Monday 06/12/2017

Friday 06/09/2017...then vs now...

Friday 06/09/2017

TECH-EXIT

The S&P looked like it was going to join the NQ but recovered

The YM seemed unaware of the other markets' action.

Thursday 06/08/2017

Wednesday 06/07/2017

Tuesday 06/06/2017

Monday 6/05/2017

Low volume, small range and little change...

Friday 6/2/2017

Thursday 6/1/2017...Paris-Exit

Seems the market likes PDT's move away from globalism

Wednesday 5/31/2017

Tuesday 5/30/2017

Monday 5/29/2017 Memorial Day

Very light half session

Friday 5/26/2017

Light volume pre-holiday...Memorial Day

Thursday 5/25/2017

Volume picked up slightly.

Prices pushed up early in the session but went basically sideways during the MMO

Thursday morn 5/25/2017

Wednesday 5/24/2017

Still moving up on low volume

Tuesday 5/23/2017

Monday 5/22/2017

Friday 5/19/2017

Volume diminishing but still wide ranges

The past week's YM sessions on a tick chart - notice the different widths between sessions.

Tick charts reflect higher activity and volume with wider distances between days.

Fri, Mon and Tue reflect more "normal" volume. Very heavy activity occurred

on Wed & Thurs - - Fri had high volume but was returning back towards normal again.

Thursday 05/18/2017

A high volume recovery but looks like we're burning the candle on both ends

Wednesday 05/17/2017

From ATHs to high volume sell off

Tuesday 05/16/2017

Little change ...long legged spinner/doji for the YM.

Monday 05/15/2017

Friday 05/12/2017

Low volume with small ranges...NQ closed up nicely

Thursday 05/11/2017

Long tailed reversal hammers with volume picking up...

Wednesday 05/10/2017

Tuesday 05/09/2017

Wide ranges again. YM & ES closing down on low volume

while the NQ closed higher

Monday 05/08/2017

Good range but little change on low activity

Open price was the HOD

Monthly and Weekly as of 05/05/2017

Just some pull-back FIBs -- where we could go.

Friday 05/05/2017

Late afternoon surge powered 'em up

Breakouts - closing at the highs

Thursday 05/04/2017

House "repeals" Obamacare ... markets close quite unimpressed.

Wide ranges on moderate volume but basically UNCH

Thursday morning...05/04/2017

FUTs moving up over-night...late to react to yesterday's FED minutes?

Yesterday's session and the start of today's on minute based charts (left) with

today's tick chart session (right) which will include the scam du jour - faux healthcare vote

Wednesday 05/03/2017

FED announced holding rates unchanged

Larger ranges although little change from yesterday closing with spinners.

The session open price acted as an OVER-UNDER line

Tuesday 05/02/2017

Low volumes...narrow ranges

Monday 05/01/2017

Quite a disconnect between the NASDAQ (leading) and the S&P 500

...but even more disconnected is the action in the DJIA

Friday 04/28/2017

Thursday 04/27/2017

Much lower volume than of late suggesting a rest is due..

but the Nasdaq is still moving up like there's no tomorrow.

The ES rising too while the YM is hesitating.

Wednesday 04/26/2017

Pretty much UNCH at the close

Tuesday 04/25/2017

Last time we saw this kind of daily range was February's EOM top.

Ain't technology grand?

Monday 04/24/2017

Rare gap breakouts, perhaps due to France's elections yesterday.

Frexit anyone?

Nasdaq leading, wide ranges & strong Chg% closing near the highs...

Friday 04/21/2017

Little change for the day and for the week with the exception of

the Nasdaq...looks like it's on the verge of leading us higher - hovering near ATHs

Thursday 04/20/2017

Wide ranges up on increased volume

Wednesday 04/19/2017

Tuesday 04/18/2017

Monday 04/17/2017

Good range gainer but on lower volume

Thursday 04/13/2017

Dropping down from the channels.

Wednesday 04/12/2017

Tuesday 04/11/2017

Long horizontal channel still holding...

-------------------------------------------------------------------

Friday 12/29/2017

Thursday 12/28/2017

Wednesday 12/27/2017

Tuesday 12/26/2017

Friday 12/22/2017

Thursday 12/21/2017

Very low volume flags forming.

Wednesday 12/20/2017

Tax bill passes

Closing spinners on low volume, down but little change

Tuesday 12/19/2017

Tax vote - both houses

Monday 12/18/2017

Friday 12/15/2017

YM daily closing ATH with a stick sandwich

ATH's for both the ES and the NQ , breaking out nicely to the upside.

Friday 12/15/2017

The December E-Mini Equity Index futures and options expired today at 8:30 am CT.

Thursday 12/14/2017

Wednesday 12/13/2017

Tuesday 12/12/2017

Monday 12/11/2017

YM&ES ATH's...what else is new?

Friday 12/8/2017

All time closing highs for the YM and ES

Thursday 12/07/2017

Wednesday 12/6/2017

Tuesday 12/5/2017

Monday 12/4/2017

Another wide range session -- very high volume sell off and recover.

Thursday 11/30/2017

Major up moves to ATHs in the YM and ES on big volume -- blow off top?

Recovery to the break-down area

Wednesday 11/29/2017

Tuesday 11/28/2017

Broader markets up big-ly, Nasdaq not so much

Monday 11/27/2017

Friday 11/24/2017...1:15 close?

Thursday 11/23/2017 - Thanksgiving session

Wednesday 11/22/2017

Tuesday 11/21/2017

All time closing highs

Monday 11/20/2017

Friday 11/17/2017

Thursday 11/16/2017

Wednesday 11/15/2017

Tuesday 11/14/2017

Monday 11/13/2017

Friday 11/10/2017

Thursday 11/9/2017

Major volume day with large ranges...retracing most of the drops by the close

YM retrace of the drop - Brach Zone Fibonacci

Wednesday 11/8/2017

NQ ATH, ES close behind, YM UNCH...lower volume

Tuesday 11/07/2017

Today's Doji-Spinners suggest a pause while markets think about where we go.

Monday 11/06/2017

Friday 11/03/2017

Thursday 11/02/2017

President Trump Announces Nominee Jerome Powell

as New Federal Reserve Chairman…

YM -- ATH at the close of the major markets.Wednesday 11/01/2017

Prices stabbing the underbelly of ATH'S but closing below.

Tuesday 10/31/2017

Monday 10/30/2017

Friday 10/27/2017

Impressive move for the NASDAQ

Thursday 10/26/2017

Wednesday 10/25/2017

High volume sell off...

Tuesday 10/24/2017

Full steam ahead for the DJIA, not so much for the ES+NQ

Monday 10/23/2017

Friday 10/20/2017

Thursday 10/19/2017

Volume returned and brought a big recovery from the overnight swoon

Wednesday 10/18/2017

Tuesday 10/17/2017

Lower volume but ATHs

Monday 10/16/2017

Very low volume NR 7 pattern completed today although the YM & NQ into ATH territory..

Friday 10/13/2017

Trump announces no deal with Iran - sends it to the cowards in Congress

Thursday 10/12/2017

Very low volume and narrow ranges

Wednesday 10/11/2017

Closing at ATHs

Tuesday 10/10/2017

Monday 10/09/2017

Low volume - small movements

Friday 10/06/2017

Thursday 10/05/2017

Closing at ATHs...again...still...

Wednesday 10/04/2017

Tuesday 10/03/2017

Monday 10/02/2017

ATHs for the YM and ES with the NQ UNCH...

Friday 09/29/2017

Thursday 09/28/2017

Continuing talk about PDT's tax plan

YM breaking out of a small flag-on-a-pole pattern...

ES broke out yesterday and continued up today ... the NQ bouncing back

after testing the lower line support of its rising wedge

Wednesday 09/27/2017

Tuesday 09/26/2017

Monday 09/25/2017

Friday 9/22/2017

Two weeks of just about continual straight up for the DJI and S&P...

The Nasdaq is rolling over within a large wedge

Thursday 09/21/2017

Wednesday 09/20/2017

FED leaves rates UNCH...subdued action leading up to announcement then the

"normal" 100 point swing accompanied the minutes

Daily and a look at the FED action on the 30 minute

Tuesday 09/19/2017

Diminished volume, range and change...

Monday 09/18/2017

Friday 09/15/2017

YM complete session and MMO session

Thursday 09/14/2017

Wednesday 09/13/2017

Tuesday 09-12-2017

Rollover to new contract

Monday 09/11/2017

Remembering 911

The ES closing in ATH territory

Friday 09/08/2017

Big down day for the NQ

Thursday 09/07/2017

Wednesday 09/06/2017

Tuesday 09/05/2017

Wide ranges...large volume on the sell offs.

Friday 09/01/2017

Weaker volume, narrow ranges and little change.

Thursday 08/31/2017

NQ reaching ATH on big percentage move...3 white soldiers.

Nice uptrend for the ES too & an increase in volume.

YM up but lagging a bit.

Wednesday 08/30/2017

Significant gain for the NQ, the ES up moderately and the YM UNCH

Tuesday 08/29/2017

Great to see the spirit of partnership that exemplifies Americans in dealing with the tragic events in Texas

Strong recovery on higher volume, closing near the highs

Overnight divergence set up the day

Monday 08/28/2017

Friday 08/25/2017

Thursday 08/24/2017

Long legged spinners closing UNCH.

Wednesday 08/23/2017

Tuesday 08/22/2017

Yesterday's long lower tails 'announced' today's recovery.

Monday 08/21/2017

Friday 08/18/2017

Thursday 08/17/2017

↓↓↓ ↓↓↓ ↓↓↓ ↓↓↓ ↓↓↓

More indecisive spinners

Tuesday 08/15/2017

Lower volume doji

Monday 08/14/2017

Strong snap backs (...as if Thursday never happened)

Friday 08/11/2017

Thursday 08/10/2017

Large ranges, major percentage drops on big volume...

Wednesday 08/09/2017

Wide ranges, long lower tail recoveries late in the day - - volume up.

Tuesday 08/08/2017

Wide ranges down and volume returned...

Monday 08/07/2017

Extreme low volume, about half the usual...

Friday 08/04/2017

YM was into new highs all week while NQ and ES lagged sideways within diamond patterns.

Thursday 08/03/2017

Wednesday 08/02/2017

YM closing refusing to drop, closing lightly up...

The ES and NQ closing slightly down but with long lower reversal tails.

Wild day starting at the MMO, VOL up too. Not recovering as much relative to the other indices.

Tuesday 08/01/2017

-------------------------------------------------------------------

----------------------------July---------------------------

Monday 07/31/2017

YM up strong, NQ down and ES pretty much UNCH...EOM positioning?

Friday 07/28/2017

DOW 30 (YM) ATH at the major market close.

Thursday 07/27/2017

Wide ranges in the NQ and ES closing down while the YM kept driving up

Volume kicked up a notch...

Wednesday 07/26/2017

DJI leading, closing at ATH...volume down a bit.

Tuesday 07/25/2017

Monday 07/24/2017...Low volume

Friday 07/21/2017

Thursday 07/20/2017

Wednesday 07/19/2017

ATH for the ES & NQ on low volume

Tuesday 07/18/2017

Monday 07/17/2017

Friday 07/14/2017

Strong week, ATH's but on lower volume.

Thursday 07/13/2017

New closing highs again...low volume again...

Wednesday 07/12/2017

YM and S&P breakouts - on lowish volume

Tuesday 07/11/2017

Monday 07/10/2017

Friday 07/07/2017

Thursday 07/06/2017

Wednesday 07/05/2017

Tuesday 07/04/2017

4th of July holiday shortened session

Monday 07/03/2017

4th of July holiday shortened session

Friday 06/30/2017

Friday morning 06/30/2017

Thursday 06/29/2017

Big volume with wide ranges ...

Divergent bottom reversal, retraced 50% of the plunge

Stick sandwiches

Wednesday 06/28/2017

Volume up a bit...

Tuesday 06/27/2017

Monday 06/26/2017

Friday 06/23/2017

Thursday 06/22/2017

Wednesday 06/21/2017

The Techs powered up strong while the big guys sold off

Tuesday 06/20/2017

Monday 06/19/2017

Friday 06/16/2017

Looks like money is still in Tech-Exit mode with the DJIA the main beneficiary.

Thursday 06/15/2017

Very low volume sessions, due to contract rollover.

Not much change, pretty wide ranges and long lower tails

Wednesday 6/14/2017

Very low volume for a FED minutes day

Tuesday 6/13/2017

ATHs for the YM and ES

Monday 06/12/2017

Friday 06/09/2017...then vs now...

Last time -- everything down on large volume...a classic Sell Mortimer, SELL!

This time -- Record high on normal volume, major league down on big volume

and wide range sideways on normal volume.

Friday 06/09/2017

TECH-EXIT

The S&P looked like it was going to join the NQ but recovered

The YM seemed unaware of the other markets' action.

Thursday 06/08/2017

Wednesday 06/07/2017

Tuesday 06/06/2017

Monday 6/05/2017

Low volume, small range and little change...

Friday 6/2/2017

Thursday 6/1/2017...Paris-Exit

Seems the market likes PDT's move away from globalism

Wednesday 5/31/2017

Tuesday 5/30/2017

Monday 5/29/2017 Memorial Day

Very light half session

Friday 5/26/2017

Light volume pre-holiday...Memorial Day

Thursday 5/25/2017

Volume picked up slightly.

Prices pushed up early in the session but went basically sideways during the MMO

Thursday morn 5/25/2017

Wednesday 5/24/2017

Still moving up on low volume

Tuesday 5/23/2017

Monday 5/22/2017

Friday 5/19/2017

Volume diminishing but still wide ranges

The past week's YM sessions on a tick chart - notice the different widths between sessions.

Tick charts reflect higher activity and volume with wider distances between days.

Fri, Mon and Tue reflect more "normal" volume. Very heavy activity occurred

on Wed & Thurs - - Fri had high volume but was returning back towards normal again.

Thursday 05/18/2017

A high volume recovery but looks like we're burning the candle on both ends

Wednesday 05/17/2017

From ATHs to high volume sell off

Tuesday 05/16/2017

Little change ...long legged spinner/doji for the YM.

Monday 05/15/2017

Friday 05/12/2017

Low volume with small ranges...NQ closed up nicely

Thursday 05/11/2017

Long tailed reversal hammers with volume picking up...

Wednesday 05/10/2017

Tuesday 05/09/2017

Wide ranges again. YM & ES closing down on low volume

while the NQ closed higher

Monday 05/08/2017

Good range but little change on low activity

Open price was the HOD

YM complete session and MMO hours

Monthly and Weekly as of 05/05/2017

Just some pull-back FIBs -- where we could go.

Friday 05/05/2017

Late afternoon surge powered 'em up

Breakouts - closing at the highs

Thursday 05/04/2017

House "repeals" Obamacare ... markets close quite unimpressed.

Wide ranges on moderate volume but basically UNCH

Thursday morning...05/04/2017

FUTs moving up over-night...late to react to yesterday's FED minutes?

Yesterday's session and the start of today's on minute based charts (left) with

today's tick chart session (right) which will include the scam du jour - faux healthcare vote

Wednesday 05/03/2017

FED announced holding rates unchanged

Larger ranges although little change from yesterday closing with spinners.

The session open price acted as an OVER-UNDER line

Tuesday 05/02/2017

Low volumes...narrow ranges

Monday 05/01/2017

Quite a disconnect between the NASDAQ (leading) and the S&P 500

...but even more disconnected is the action in the DJIA

Friday 04/28/2017

Thursday 04/27/2017

Much lower volume than of late suggesting a rest is due..

but the Nasdaq is still moving up like there's no tomorrow.

The ES rising too while the YM is hesitating.

Wednesday 04/26/2017

Pretty much UNCH at the close

Tuesday 04/25/2017

Last time we saw this kind of daily range was February's EOM top.

Ain't technology grand?

Monday 04/24/2017

Rare gap breakouts, perhaps due to France's elections yesterday.

Frexit anyone?

Nasdaq leading, wide ranges & strong Chg% closing near the highs...

Friday 04/21/2017

Little change for the day and for the week with the exception of

the Nasdaq...looks like it's on the verge of leading us higher - hovering near ATHs

Thursday 04/20/2017

Wide ranges up on increased volume

Wednesday 04/19/2017

Tuesday 04/18/2017

Monday 04/17/2017

Good range gainer but on lower volume

Thursday 04/13/2017

Dropping down from the channels.

Wednesday 04/12/2017

Tuesday 04/11/2017

Monday 4/10/2017

Friday 4/07/2017

Closing with hammer- like spinners... the long lower tails of late suggesting

a reluctance to drop in spite of this week's news

Friday Morning 4/7/2017 ... Bombs away !

so is this bullish?

Thursday 04/06/2017

Positive spinners following yesterdays wide ranges

Wednesday 04/05/2017

Wild ride with increased volume...

The sell-off gets put on on the FED minutes, released this afternoon.

Seems like old news to me but people just gotta have their reason "why"

Tuesday 04/0/2017

Lower volume and smaller ranges though long lower tails persist...

Monday 04/03/2017

Basically UNCH on the session...but:

Wide ranges closing with hammer-ish doji candles having long lower tails...

Long lower tails are significant IMO...it indicates the bullishness of market participants

i.e. a willingness to buy the dips, the buy-low mentality is in effect....

Beautiful long tailed divergent reversal thru lunch

Long tailed doji on the ES and NQ too...

Friday 03/31/2017

Thursday 3/30/2017

The NQ closing with a little spinner in ATH territory but hesitating...

...perhaps waiting for the big boys to catch up.

Wednesday 3/29/2017

Techs approaching ATHs leading the big boys...volume down significantly

Monday 03/27/2017

WR long lower hammer-ish looking candles

Friday 03/24/2017

Friday 4/07/2017

Closing with hammer- like spinners... the long lower tails of late suggesting

a reluctance to drop in spite of this week's news

Friday Morning 4/7/2017 ... Bombs away !

so is this bullish?

Thursday 04/06/2017

Positive spinners following yesterdays wide ranges

Wednesday 04/05/2017

Wild ride with increased volume...

The sell-off gets put on on the FED minutes, released this afternoon.

Seems like old news to me but people just gotta have their reason "why"

Tuesday 04/0/2017

Lower volume and smaller ranges though long lower tails persist...

Monday 04/03/2017

Basically UNCH on the session...but:

Wide ranges closing with hammer-ish doji candles having long lower tails...

Long lower tails are significant IMO...it indicates the bullishness of market participants

i.e. a willingness to buy the dips, the buy-low mentality is in effect....

Beautiful long tailed divergent reversal thru lunch

Long tailed doji on the ES and NQ too...

Friday 03/31/2017

Up slightly relative to last Friday

Thursday 3/30/2017

The NQ closing with a little spinner in ATH territory but hesitating...

...perhaps waiting for the big boys to catch up.

Wednesday 3/29/2017

Techs approaching ATHs leading the big boys...volume down significantly

Tuesday 3/28/2017

Yesterday's hammers called today's recovery...Good volume + Wide RangesMonday 03/27/2017

WR long lower hammer-ish looking candles

Friday 03/24/2017

Closing spinners, WR bars with long lower tails on the big boys...volume still elevated.

The NQ is posting gains...The MACD trends have been down for most of March

The NQ is posting gains...The MACD trends have been down for most of March

and stochasti' are still a bit outside the over-sold "BUY" areas.

So, off-setting bull/bear technicals showing on the dailies. But it only takes one positive day

for the STO's to begin hooking up ... **** I say GAINs next week **** (correct albeit slightly)

Keep in mind, Wed's Hammer-Harami did pause the slaughter ...

Keep in mind, Wed's Hammer-Harami did pause the slaughter ...

Thursday 03/23/2017

NR closing UNCH on moderate volume

Wednesday 03/22/2017

Closing with Hammer-Harami (expect a pause or reversal of trend).

Volume high but lower than yesterday.

Tuesday 3/21/2017

Big move on volume, down from the MMO thru the close.

Monday 3/20/2017

Slow, low volume day closing UNCH...

Friday 3/17/2017

Thursday 3/16/2017

Spinners for the YM & ES...The big boys are tentative after their breakouts but the techs say go-go-go

Wednesday 03/15/2017...Fed Raises Rate

Tuesday 03/14/2017

Larger volume but still treading sideways.

Monday 03/13/2017

Minor upwards bias but little changed...Rolled to June contract

Friday 03/10/2017

Thursday 03/09/2017

Closing spinners basically UNCH with volume increasing...

Wednesday 03/08/2017

Tuesday 03/07/2017

Monday 03/06/2017

Friday 03/03/2017

Thursday 03/02/2017

Wednesday 03/01/2017

*******************************************************************************

Tuesday 02/28/2017

Narrow range closing UNCH with spinners

Monday 02/27/2017

Friday 02/24/2017

Thursday 02/23/2017

Wednesday 02/22/2017

Tuesday 02/21/2017

Monday 02/20/2017 Shortened session for President's Day

Friday 2/17/2017

Thursday 02/16/2017

Wednesday 02/15/2017

Tuesday 02/14/2017

Monday 02/13/2017

Breaking out with three white soldiers

Friday 02/10/2017

Thinking the ES & YM go sideways into Friday's OEX (wrong).

Wednesday 02/08/2017

NR consolidation on dropping volume over the past few...

Tuesday 02/07/2017

Monday 02/06/2017

Stochastic on the daily charts are hooking up while

on the 30 minute they are hooking down...NR sessions

Friday 02/03/2017

Tales did tell tales and prices went up on decent volume.

Thursday 02/02/2017

Long lower tails for the past several sessions and strong volume denotes accumulation in my estimation.

Wednesday 02/01/2017 ...FED minutes today - no change in rates...

Tuesday 01/31/2017

Wide ranging hammer closes ... ES and NQ ending positive. Long lower tails on volume.

Monday 01/30/2017

Friday 01/27/2017

Thursday 01/26/2017

Wednesday 01/25/2017

Break-outs to all time closing highs...looking like January is heading towards

ending the month positively...The old saw : as goes January, so goes the year.

Tuesday 01/24/2017

Monday 01/23/2017

Friday 01/20/2017 - Inauguration day

Thursday 01/19/2017

Wider ranges little change for the YM & ES and long lower tails ...

The NQ hitting a new ATH but closing with a spinner...

Wednesday 01/18/2017

Tuesday 01/17/2017

Volume pop, prices drop

Monday 01/16/2016

Shortened MLK holiday session

Friday 01/13/2017

Thursday 01/12/2017

Wide ranges on larger volume...closing down with large lower tails.

Wednesday 01/11/2017

Increased volume, closing nearer the highs...Seems that the NQ is leading the charge

Day 2 of cabinet confirmations (Sessions + Tillerson), 1st Trump press conference...Trump (paraphrase) :

I'll not take a question from CNN - you are fake news.

Tuesday 01/10/2107

Basically UNCH on 'normal' volume

Monday 01/09/2017

Friday 01/06/2017

Thursday 01/05/2017

Three soldiers for the NQ with the ES and YM flat.

Wednesday 01/04/2017

Upward movement toward resistance on more-or-less 'normal' volume.Tuesday 01/03/2017

Volume returned, wide ranges closing up

Friday 12/30/2016

Long down candles on increased volume

Thursday 12/29/2016

Spinners into the close

Wednesday 12/28/2016

Breakdown...on volume increase

Tuesday 12/27/2016

Minor breakout & retreat for the ES, strong break in the NQ...very low holiday volume continues.

Friday 12/23/2016

Light pre- Christmas consolidation action

Thursday 12/22/2016

Volume increased a bit, prices little changed...consolidation still happening

following the post election run-up

Flags on poles...measured move potential still intact.

Wednesday 12/21/2016

Very low volume closing at the lows...ES & YM squeezing basically UNCH...

NQ doing it's own thing

Tuesday 12/20/2016

Minor breakouts of consolidation patterns but on very low volume.

Monday 12/19/2016

-------------------------Friday 12/16/2016------------------------

Measured move targets

-------------------------Thursday 12/15/2016------------------------

Symbol rollover to March is tomorrow

-------------------------Wednesday 12/14/2016------------------------

Very wide ranging bars in the afternoon. Very noticeable in the ES and YM.

Blame it on the FED - interest rate rise.

-------------------------Tuesday 12/13/2016------------------------

Big recoveries from Monday's action, esp. for the NQ.

-------------------------Monday 12/12/2016------------------------

Markets slowing down - December Futures rollower Friday

-------------------------Friday 12/09/2016------------------------

Continued drive up on much lower volume

-------------------------Thursday 12/08/2016------------------------

-------------------------Wednesday 12/07/2016------------------------

Major move up on large volume...

-------------------------Tuesday 12/06/2016-------------------------

-------------------------Monday 12/05/2016-------------------------

The ES and NQ broke up strong from yesterday's spinner/doji ... YM closed up with an outside bar.

-------------------------Friday 12/02/2016-------------------------

Indecisive spinners on the ES and NQ...DJI down but building a little pennant

-------------------------Thursday 12/01/2016-------------------------

The NQ moving substantially down with the ES down...the YM holding the line...

Volume is larger than the past few days...

-------------------------Wednesday 11/30/2016-------------------------

-------------------------Tuesday 11/29/2016-------------------------

-------------------------Monday 11/28/2016-------------------------

-------------------------Friday 11/25/2016-------------------------

Shortened session

-------------------------Thursday 11/24/2016-------------------------

Thanksgiving shortened session

-------------------------Wednesday 11/23/2016-------------------------

Continued drive up on much lower volume

-------------------------Thursday 12/08/2016------------------------

-------------------------Wednesday 12/07/2016------------------------

Major move up on large volume...

-------------------------Tuesday 12/06/2016-------------------------

-------------------------Monday 12/05/2016-------------------------

The ES and NQ broke up strong from yesterday's spinner/doji ... YM closed up with an outside bar.

-------------------------Friday 12/02/2016-------------------------

Indecisive spinners on the ES and NQ...DJI down but building a little pennant

-------------------------Thursday 12/01/2016-------------------------

The NQ moving substantially down with the ES down...the YM holding the line...

Volume is larger than the past few days...

-------------------------Wednesday 11/30/2016-------------------------

-------------------------Tuesday 11/29/2016-------------------------

-------------------------Monday 11/28/2016-------------------------

-------------------------Friday 11/25/2016-------------------------

Shortened session

-------------------------Thursday 11/24/2016-------------------------

Thanksgiving shortened session

-------------------------Wednesday 11/23/2016-------------------------

Editing issues required creating new EOD page.

Click for (Previous) EOD charts prior to November 2016