Of course the returns would also be reduced. Will have to continue using the regular FUTs charts for long term tracking because the micros are too new to have enough daily price history.

Other things I'm considering for determining rules:

♦ add 20% of Friday"s range to Friday's CLOSE as entry levels

... for Sunday's session open and Monday's 9:30 open

♦ buy the open price, Sunday night and Monday's MMO

♦ buy the MMO dependent on Sunday night's action:

... on a pop - use a buy-limit below Sunday night's range to catch a pull back

... on a drop - trail down a buy stop from above

♦ it's looking like each market may need individualized rules...

♦ want to compare the market results ie: the amount of draw down dollars that needs to be with-stood

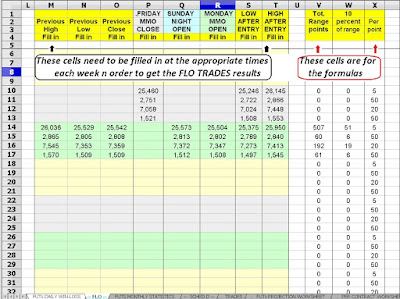

Working on a spreadsheet to record & analyze the data:

Update 4/10/2019

Made some modifications in an attempt to simplify the data gathering needed to power the spreadsheet.

4/01/2019