Short reviews of the day's market action after the majors close....for 2018

-------------------------------------------------------------------

-------------------------------------------------------------------

12/31/2018 Monday

12/28/2018 Friday

12/27/2018 Thursday

Nice 2 day rally on big volume

Wednesday 12/26/2018

Consumer spending for Christmas up 42% over last year, which was also a "good" year

Monday 12/24/2018

Friday 12/21/2018

Thursday 12/20/2018

Wednesday 12/19/2018

Another FED day

Tuesday 12/18/2018

Monday 12/17/2018

Friday 12/14/2018

Rollover to Mar 19 contract

Thursday 12/13/2018

Minor indecisive doji on slightly higher than 'normal' volume

Wednesday 12/12/2018

Wednesday morning 12/12/2018

Tuesday 12/11/2018

Monday 12/10/2018

Friday 12/07/2018

Thursday 12/6/2018

Extreme 900 point YM range and large volume

Wednesday 12/5/2018

Market closed at 9:30 AM observing President Bush, RIP

Tuesday 12/4/2018

Monday 12/3/2018

6:30 AM Monday morning

Friday 11/30/2018

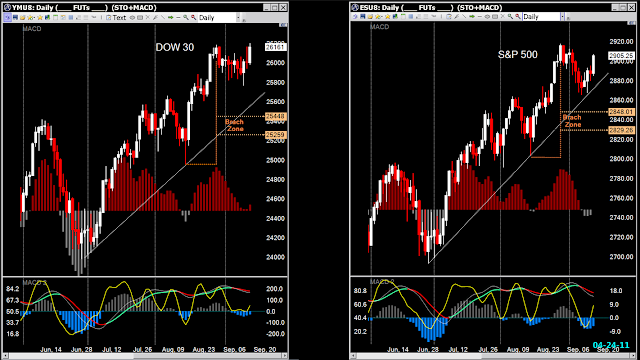

Strong close to November...Into the Brach Zones

Thursday 11/29/2018

Wednesday 11/28/2018

Impressive wide range candles

Tuesday 11/27/2018

2 strong post holiday up days ... which way from here?

Stochastic is definitely hooking up, the Mac Histo's have turned -- the fast EMAs are trying to.

But I'm thinking the bulls might be a tad early...I'd be more convinced of a sustainable bottom

if the minor measured moves had been reached...We'll see.

The little guys were not participating today.

Friday 11/23/2018

Thursday 11/22/2018...Thanksgiving

Wednesday 11/21/2018

Morning

Tuesday 11/20/2018

Monday 11/19/2018

Friday 11/16/2018

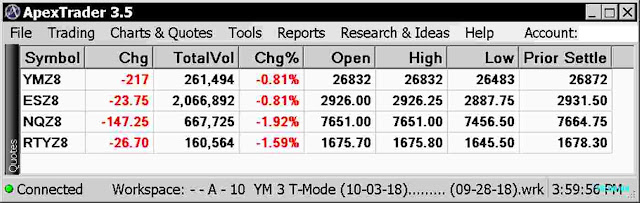

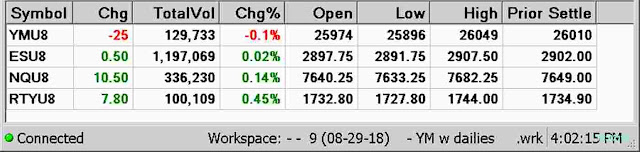

Quotes displayed incorrect values for the Chg, Chg%, Open and Prior Close today.

The High was incorrectly displayed then was corrected ~ 10:15 AM today.

(All values were correct for Friday's session until ~9:30 PM Thursday)

Thursday 11/15/2018

Wednesday 11/14/2018

Tuesday 11/13/2018

Monday 11/12/2018

Friday 11/09/2018

DOW 30 daily and full session

Thursday 11/8/2018

Wednesday 11/07/2018

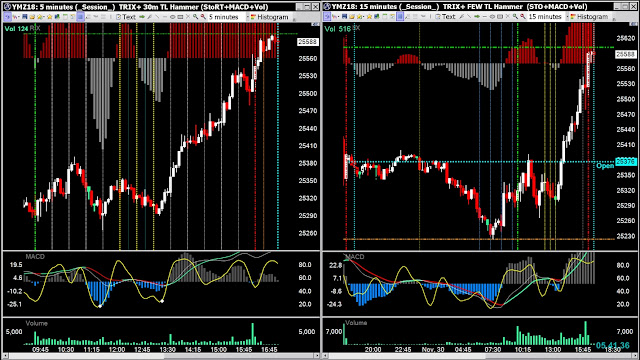

YM session and MMO

Tuesday 11/06/2018 - Mid term elections

Monday 11/05/2018

Friday 11/02/2018

This Morning

Thursday 11/01/2018

Breaking the down trend with three white soldiers ... A bullish pattern.

Does it only tell what has transpired or does it suggest that the reversal continues?

Wednesday 10/31/2018

A look at the over night sessions

Tuesday 10/30/2018

DOW 30 full session and MMO

Monday 10/29/2018

12/28/2018 Friday

12/27/2018 Thursday

Nice 2 day rally on big volume

Wednesday 12/26/2018

Consumer spending for Christmas up 42% over last year, which was also a "good" year

Monday 12/24/2018

Friday 12/21/2018

Thursday 12/20/2018

Wednesday 12/19/2018

Another FED day

Tuesday 12/18/2018

Monday 12/17/2018

Friday 12/14/2018

Rollover to Mar 19 contract

Thursday 12/13/2018

Minor indecisive doji on slightly higher than 'normal' volume

Wednesday 12/12/2018

Wednesday morning 12/12/2018

Tuesday 12/11/2018

Monday 12/10/2018

Friday 12/07/2018

Thursday 12/6/2018

Extreme 900 point YM range and large volume

Wednesday 12/5/2018

Market closed at 9:30 AM observing President Bush, RIP

Tuesday 12/4/2018

Monday 12/3/2018

6:30 AM Monday morning

Friday 11/30/2018

Strong close to November...Into the Brach Zones

Thursday 11/29/2018

Wednesday 11/28/2018

Impressive wide range candles

Tuesday 11/27/2018

2 strong post holiday up days ... which way from here?

Stochastic is definitely hooking up, the Mac Histo's have turned -- the fast EMAs are trying to.

But I'm thinking the bulls might be a tad early...I'd be more convinced of a sustainable bottom

if the minor measured moves had been reached...We'll see.

The little guys were not participating today.

The MMO session and full session charts were strong thru the session end.

Monday 11/26/2018

Friday 11/23/2018

Thursday 11/22/2018...Thanksgiving

Wednesday 11/21/2018

Morning

Tuesday 11/20/2018

Monday 11/19/2018

Friday 11/16/2018

Quotes displayed incorrect values for the Chg, Chg%, Open and Prior Close today.

The High was incorrectly displayed then was corrected ~ 10:15 AM today.

(All values were correct for Friday's session until ~9:30 PM Thursday)

Thursday 11/15/2018

Wednesday 11/14/2018

Tuesday 11/13/2018

Monday 11/12/2018

Friday 11/09/2018

DOW 30 daily and full session

Thursday 11/8/2018

Wednesday 11/07/2018

YM session and MMO

Tuesday 11/06/2018 - Mid term elections

Full YM session and MMO

Monday 11/05/2018

Friday 11/02/2018

This Morning

Thursday 11/01/2018

Breaking the down trend with three white soldiers ... A bullish pattern.

Does it only tell what has transpired or does it suggest that the reversal continues?

I'm thinking that market direction depends on the election results this Tuesday...

Wednesday 10/31/2018

A look at the over night sessions

Tuesday 10/30/2018

DOW 30 full session and MMO

Monday 10/29/2018

Morning before the majors open...looking like follow-through from Friday's T/A

Friday 10/26/2018

YM session + MMO

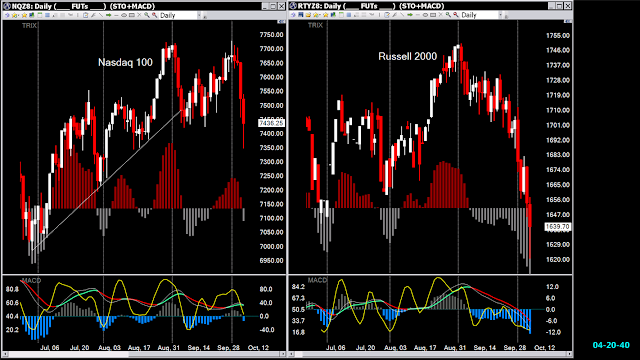

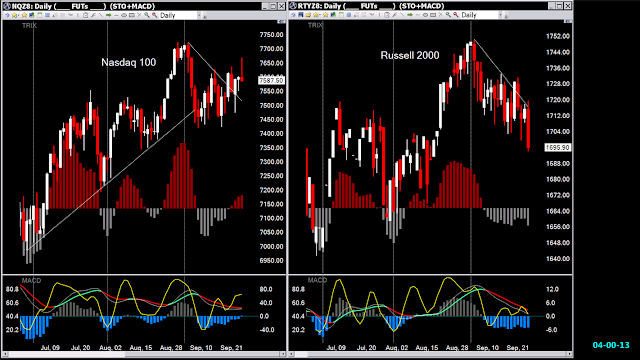

Dailies -

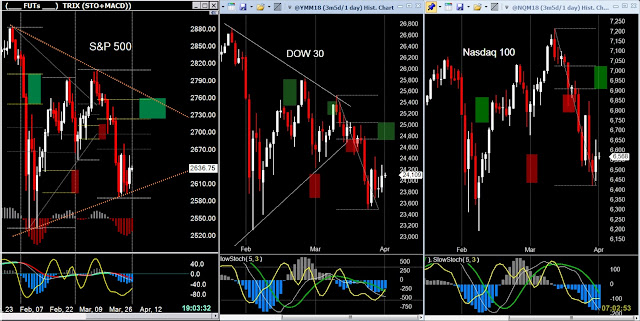

Bearish : measured moves are still in play...Bullish : the histograms are divergent

while the long lower tails search for a bottom...

I'm guessing that a short term up blip is in the works.

MACD EMAs are down (TREND), Stochastic are turning in the O/S areas (WHEN)

Thursday 10/25/2018

-----------------------------------------------------------------------------------------------------------------

Wednesday 10/24/2018

Very wide ranges out doing yesterday. It's looking like measured moves before they turn

Targets: YM 23800, ES 2585, NQ 6550

Tuesday 10/23/2018

Major league divergent reversal this morning after the majors opened...

Closing with wide raging long tailed hammers -- attempting to to reverse the down trend ??

(nope)

Monday 10/22/2018

Friday 10/19/2018

Thursday 10/18/2018

Wednesday 10/17/2018

DOW 30 full session and major market hours

Tuesday 10/16/2018

Morning news release:

Hires set a new high of 5.8 Million in August.

Job openings (vacancies) also hit a series high of 7.1 Million.

At the close:

Large percentage changes...Seems last week's long lower shadows called the reversal.

YM major market open thru the close and the entire session.

Monday 10/15/2018

Friday 10/12/2018

As of logging in to my account at 6 AM this morning :

Margins have reverted to the normal $500 during the day and $1000 overnight...

I'm not clear on when "normal" day hours begin and overnight margins end.

Higher than "normal" volume on the rebound today tho not as much as the previous sell-offs.

. There's the over-n-under Open price game on the session charts again.

|

| Friday's entire session and the MMO hours |

Wondering whether the over-sold long tails have reversed the selling...

The NQ chart is showing a positive hammer for yesterday. It was negative

when the major's closed last night so it switched between 4 & 5 PM

Thursday 10/11/2018

Margins were reduced to $1000 before the majors opened then reverted to $500 at noon.

Higher volume than yesterday's massive amount...

Wednesday 10/10/2018

Overnight margins were set to $2000 at the session close today...

Tuesday 10/9/2018

Monday 10/8/2018

The big boys with long lower tails but closing UNCH...

At the MMO the RUT was down and the NQ was down largish but by the session close

they both had long lower tails too...

Friday 10/5/2018

The long lower shadows on the latest sessions indicate to me that there's not a great

amount of conviction to the down side in spite of the large volume again today.

But technically there are more negatives than positives: the Stochastics + MACDs

are turning down and the S&P breaking it's uptrend is worrisome...

Thursday 10/4/2018

Large volume sell off across the boards

Wednesday 10/3/2018

Tuesday 10/2/2018

Somewhat odd for the DOW 30 to be rallying while the others drop

Seems there's rush out of the little guys

Industrials for Tuesday

Monday 10/01/2018

NAFTA is dead, long live USMCA

DOW 30 major market hours and full session

Friday 09/28/2018

Thursday 09/27/2018

A little late in posting so the start of Friday's session shows...

Wednesday 09/26/2018

Tuesday 09/25/2018

Tough trading today...

Monday 09/24/2018

Some how missed recording today's action

Friday 09/21/2018

Thursday 09/20/2018

Wide ranges and all closed up strong

The YM repeating yesterday's P/A pattern

Wednesday 09/19/2018

Symbol rollover to December contract

Few opportunities to take reversals during the MMO today

Tuesday 09/18/2018

Nothing but air...errr, up

Monday 09/17/2018

Friday 09/14/2018

Hurricane Florence hitting the Carolinas today

Basically UNCH with long legged spinners...except for the RUT which was up nicely

Big dump for lunch, sure to be explained by the talking heads

Thursday 09/13/2018

Volume continues to come in...big boys and the Nas up while the RUT was UNCH

YM trended up for nearly the entire session

Wednesday 09/12/2018

Wide ranges increased volume.

The big boys closing with spinning doji, little changed.

The little guys down large but recovering

DOW 30 session 3m, 7m and 15 minute time frames

Tuesday 09/11/2018

Never Forget

Monday 09/10/2018

Looks like the YM took a break - positive action moved to the others

YM - divergence before the Trend Line Break at lunch time wasn't enough to stop the bleeding

Friday 09/07/2018

Again an increase in volume. YM still hanging tough - sideways channel

Similar to yesterday albeit the MMO was the pivot

Thursday 09/06/2018

Wide ranges on volume - YM closing up all by itself

The YM vacillated above/below the open the entire session.

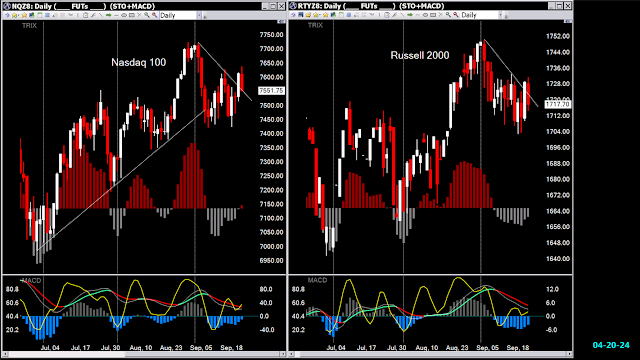

NQ into the BZ, down hard again with the S&P and RUT following

Wednesday 9/05/2018

Missed posting today or accidentally deleted somehow

Tuesday 09/04/2018

Volume picked up a bit today

YM session closed down, the MMO closed up...

Monday 09/03/2018

Labor Day Holiday shortened session

Friday 08/31/2018

All Stochastic are hooking down thus the BZ retrace levels are shown...

Is all the good economic news of late backed into price?

Thursday 08/30/2018

Except for early in the session yesterday, never into positive territory

Wednesday 08/29/2018

Wednesday 08/29/2018 before the MMO

Tuesday 08/28/2018

Monday 08/27/2018

Friday 08/24/2018

ES session and MMO

Thursday 08/23/2018

ES session and MMO

Wednesday 08/22/2018

Nasdaq catching up with a good %change...the Russell, S&P and DJI are O/B

Tuesday 08/21/2018

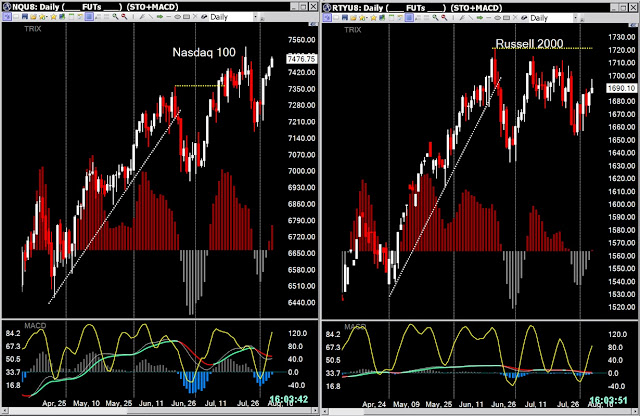

The RUT had a big move up, NASDAQ lagging somewhat

Monday 08/20/2018

Back to very low volume again and small ranges.

Friday 08/17/2018

Thursday 08/16/2018

July sales up significantly

Wednesday 08/15/2018

Tuesday 08/14/2018

S&P trend line held again today...albeit on diminished volume

Monday 08/13/2018

The ES bounced off it's trend line but more downside looks likely.

Friday 08/10/2018

Volume picked up on the sell off.

Thursday 08/09/2018

Very low volume continues

Wednesday 08/08/2018

Very low volume over the past few sessions.

Tuesday 08/07/2018

Monday 08/06/2018

Friday 08/03/2018

Thursday 08/02/2018

DOW 30 lagging today but made a strong recovery from its low

Wednesday 08/01/2018

Less down volume today vs. yesterday's up volume...Stick sandwich on the YM

Tuesday 7/31/2018

Monday 0730/2018

Friday 07/27/2018

Good economic numbers came out at lunchtime to temper the losses...

Thursday 07/26/2018

Wednesday 07/25/2018

400k surge in volume in the last 1/2 hour accounts for 50% of the ES gain on the session.

Possibly due to reports that Trump secures concessions from EU

WARNING - the link above goes to a BS-CNBC story

Thinking the RUT will be the one to play for the next few days for it to catch-up

Tuesday 07/24/2018

Monday 07/23/2018

Friday 07/20/2018

Thursday 07/192018

Odd that the RUT was up while the others were down...

Wednesday 07/18/2018

Tuesday 07/17/2018

Volume picked up a bit today...positive bias but the NQ Chg% was up substantially.

Monday 07/16/2018

Very low volume again today

Friday 07/13/2018

ISP was down Thursday 07/12/2018

Wednesday 07/11/2018

Wednesday morning 7/11/2018 - Elevated volume overnight

Tuesday 07/10/2018

Fat Finger sell off at the close of the session?

Monday 07/09/2018

Friday 07/06/2018

Break out today resulting in a Brach Zone retrace of June's hi-lo

Thursday 07/05/2018

Tuesday 07/03/2018

Early close due to the 4th of July holiday

Monday 07/02/2018

Friday 06/29/2018

Up nicely much of the day to close UNCH

Thursday 06/28/2018

Wednesday 06/27/2018

Tuesday 06/26/2018

Pausing to look around at the bigger picture

Monday 6/25/2018

Breaking their patterns on big volume.

Friday 06/22/2018

Friday morning moving up

Thursday 06/21/2018

Wednesday 06/20/2018

Tuesday 06/19/2018

Long lower tails, wide ranges - recovery in the afternoon

In the morning, before the MMO

The rising wedge seems the dominant pattern at this point

Monday 06/18/2018

The Russell was still running while the others look like they're rolling over.

Friday 06/15/2018

Thursday 6/14/2018

Initial IG report to President Donald Trump and to the Congress today.

Leaks beforehand indicate that Strzok/Page 'we'll stop Trump' email exchange was not redacted...

it WAS NEVER INCLUDED in the earlier subpoenaed documents provided to Congress.

Strong positive close...due to the relief that the truth is finally coming out?

Also today I discovered I receive data for the Russell 2000 (RTY).

It still trades in .10 tick increments but each tick is $5 (previous market I traded was $10)

Wednesday 06/13/2018

FED raises rate 1/4 point...Very low volume today. Apparently traders

have rolled to the Sept contract (U8)...

Tuesday 06/12/2018

Volume dropped a bit lower today...is everybody rejecting the news from the Korean peace talks???

Monday 06/11/2018

Price has penetrated into the Brach Zones and stochastic is overbought, suggesting pullbacks

are due for the big boys similar to what the NQ is experiencing now.

My guess is they'll be mild-ish before the May-June measured moves can continue.

Friday 06/08/2018

Thursday 06/07/2018

Volume picked up today...YM playing catch up as the ES & NQ stall

Wednesday 06/06/2018

Volume picked up, back to 'normal'

Morning charts - Pushing up overnight

Tuesday 06/05/2108

More low volume and little change

Monday 06/04/2018

Wide-ish ranges on very low volume

Friday 06/01/2018

Best jobs report in years - no, decades...! On pace to have 4.7% GDP growth in Q2...

also - NK talks are back on

Strong Jobs Report Boosts Stocks, While S&P 500 Nears May High

This article was originally published in John Murphy's Market Message on Friday, June 1st at 1:19pm EST. Below is a copy/paste from StockCharts.com - ChartWatchers free newsletter

A stronger than expected jobs report for May is giving a boost to stocks today. So is the fact that European stocks are rising (as well as Italy's bond and stock markets). In addition, yesterday's stock selling in response to new tariffs was relatively mild which is also encouraging. The bottom line is that stocks are having a strong day today and are starting the month of June in a stronger technical condition. Chart 1 shows the S&P 500 ending the week on a strong note and on pace to challenge its May high near 2742. A close above that level would restore the market's uptrend. There are three other encouraging signs on Chart 1. One is the fact that Tuesday's Italy-inspired selloff bounced off its 50-day average. The second is that the SPX also bounced off the falling trendline drawn over its January/March highs. That resistance line was exceeded three week's ago to the upside. One of the rules of chart analysis is that a resistance line once broken on the upside should act as a support line on subsequent pullbacks. The black arrow shows it doing just that on Tuesday. The third positive sign is the ability of the 14-day RSI line (top box) to stay above the 50 level. That's usually a sign of rising momentum. Nine sectors are in the black today being led by technology. Consumer staples are lagging. Utilities are the day's biggest losers owing to a rebound in Treasury yields. Today's rebound in stocks is causing some selling of bonds and bond proxies. That also suggests that Tuesday's flight to safety into Treasuries may have run its course.

Thursday 05/31/2018

Well, this was unexpected

Reversal of yesterday's action albeit on less volume...

Tuesday 05/29/2018

Wide range day on increased volume

Friday 05/25/2018

Low volume before the Memorial Day weekend

Thursday 05/24/2018

Little change, closing hammers

Wednesday 05/23/2018

Wider range on slightly increased volume

Tuesday 05/22/2018

Cool - went down on even lower volume than 'normal' today.

Seems like the abby normal has become the new normal...

Monday 05/21/2018

Big boys gapped up but on low volume. Makes me think I may have missed

contract roll-over but no...Just seasonal??

Friday 05/18/2018

Very low volume approaching the pennant apex which confirms the pattern.

Because a pennant formed instead of a reversal, I'm expecting the trend

to continue next week with a breakout to the upside.

Friday morning before the major markets open - pennant on a pole

Thursday 05/17/2018

Wednesday 05/16/2018

Tuesday 05/15/2018

Volume pickup with the reversal...

Measured moves thru lunch time

Monday 05/14/2018

Low volume closing with a weak doji and completing measured moves

Friday 05/11/2018

All over bought with candle pairs resembling those of just before last month's reversal.

This month's positive sentiment vs last month's may over power the negative TA

Thursday 05/10/2018

Wednesday 05/09/2018

Wednesday Morning

So, perhaps the world may not yet be doomed due to our ending the Iran deal...

What new false premises shall be promoted next?

Tuesday 05/08/2018 -- Iran "Deal" -- gone.

Anticipated market volatility due to President Trump's decision never happened.

Monday 05/07/2018

Up on diminished volume

Friday 05/04/2018

Thursday 05/03/2018

Volume picked up...closing with another set of long tailed Harami-Hammers

Wednesday 05/02/2018

Tuesday 05/01/2018

Tuesday Morning

******************************************************

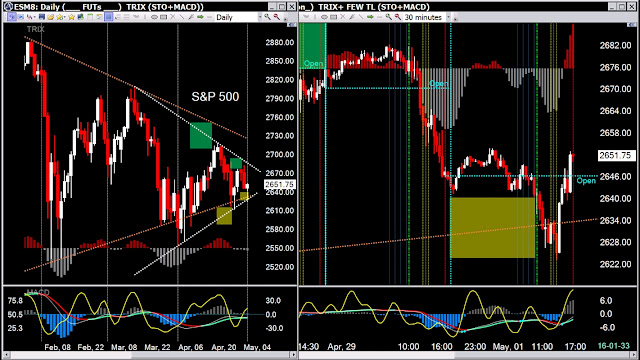

Monday 04/30/2018

Friday 04/27/2018

Thursday 04/26/2018

Nice follow through on previously mentioned T/A -- volume was a bit lite though.

Been thinking about how prices have been rising on low volume but it takes

much more to get prices to drop. Conventional wisdom calls this 'normal' P/A which supposedly

bodes against a sustained rally...Got to wonder how often this convention is incorrect.

Wednesday 04/25/2018

2 days with long lower tails into the BZs and closing with Hammer Harami today

Tuesday 04/24/2018

Increased volume on the big down bars suggests a blow off bottom at the BZ reversal areas.

Monday 04/23/2018

Friday 04/20/2018

Retreating from the BZs as this week's breakout levels are re-tested...Down with wider ranges, volume still moderate.

Thursday 04/19/2018

Pull back on moderate volume

Wednesday 04/18/2018

Tuesday 04/16/2018

Good advance albeit on low volume. Breaking out of April's consolidation patterns...

Almost into the BZ reversal areas which may prove to be the upper limits for this run.

Monday 04/16/2018

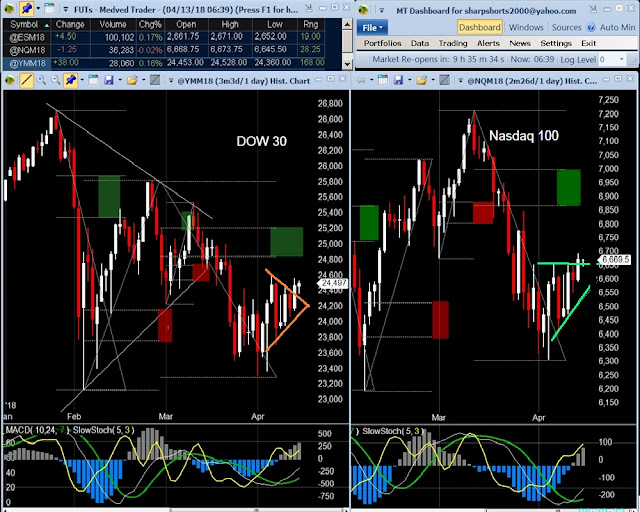

Friday 04/13/2018

Range narrowing and volume subdued, ending the week with indecisive spinning doji.

April's consolidation patterns are at their apexes but are holding...

Friday morning before the MMO -- still on the cusp of breaking out...

Thursday 04/12/2018

Wednesday 04/11/2018

Tuesday 04/10/2018

Tuesday morning after China announces easing auto tariffs

Monday 04/09/2018

Wide ranges, up all day until the late afternoon...closing basically UNCH

Friday 04/06/2018

Seems like wide range high volume has become the new normal so far this year

Thursday 04/05/2018

Wednesday 04/04/2018

Wide ranges with large volume

Tuesday 04/03/2018

Monday 04/02/2018

April BZ retrace possibilities...(04/01/2018)

Thursday 03/29/2018

Wednesday 03/28/2018

Increased volume - the big boys closing UNCH with spinners and the NQ down

Tuesday 03/27/2018

Negative stick sandwiches giving yesterday's gains back

Outside bar bodes poorly for any upward movement tomorrow

Monday 03/26/2018

Wide ranges on volume

Friday 03/23/2018

Thursday 03/22/2018

High volume breakdown patterns after Harami Hammers formed in the BZs

Tuesday 03/20/2018

Little low volume spinners printing inside bars and Harami reversal pairs

at short term BZ areas

Monday 03/19/2018

Friday 03/16/2018

Indecisive little spinners on low volume -- down for the week.

Thursday 03/15/2018...contract rollover

Wednesday 03/14/2018

Tuesday 03/13/2018

Sell-off on fairly low volume

Monday 03/12/2018

Friday 03/09/2018

Large percentage gains on moderate volume capping a solid positive week...

The Nasdaq 100 closed at an ATH but the YM & ES are lagging far behind

Friday before the MMO 03/09/2018

Thursday 03/08/2017

Wednesday 03/07/2018

Tuesday 03/06/2018

Long lower tails may suggest upward pressure for Sunday/Monday

Hammer Harami patterns

Thursday 03/01/2018

Wednesday 02/28/2018

Tuesday 02/27/2018

Monday 02/26/2018

Friday 02/23/2018

Thursday 02/22/2018

Wednesday 02/21/2018

Tuesday 02/20/2017

Monday 02/19/2018

1/2 session low volume little movement

Friday 02/16/2018

Rosenstein announces 13 indictments (+3 'entities') of Russians for interference

in US elections...FISA court throws the onus back to the DOJ re: warrants.

Thursday 02/15/2018

Wednesday 02/14/2018

Strong up sessions on volume. Stochastic is running but MACD trend (EMAs) has not turned as of yet.

Tuesday 02/13/2018

Monday 02/12/2018

Volatility remaining high...It's relatively early to expect a retrace as of yet although

I've marked the BZ areas...stochastic indicators are turning up from the O/S area.

Friday 02/09/2018

Again volume and volatility remained very high

Thursday 02/08/2018

Volume and volatility remained very high

Wednesday 02/07/2018

Futs margin reduced back to normal (9:30 AM)

Tuesday 02/06/2018

Very heavy volume with very wide ranges again today.

Monday 02/05/2018

Reality sets in - 100% margin on Futs instituted

Friday 02/02/2018

something evil in Washington has been exposed

Thursday 02/01/2018

The Nunes memo reportedly will be released tomorrow

Wednesday 01/31/2018

Tuesday 01/30/2018

State of the Union address tonight

Monday 01/29/2018

#2 McCabe at FBI "removed" from position...

House votes tonight whether to @ReleaseTheMemo

Friday 01/26/2018 ATH

Thursday 01/25/2018

YM & ES (MMO) closing ATHs as well as at the session close.

Wednesday 01/24/2018

Tuesday 01/23/2018

Monday 01/22/2018... ATH

Monday morning 01/22/2018

Looking like this week may be pivotal

Friday 01/19/2018...ATH

Thursday 01/18/2018

Wednesday 01/17/2018...ATH

Tuesday 01/16/2018

Monday 01/15/2018...ATH

MLK holiday half session

Friday 01/12/2018...ATH

Thursday 01/11/2018...ATH

Wednesday 1/10/2018

Tuesday 01/09/2018

Monday 01/08/2018

Inadvertently missed recording today's charts

Friday 01/05/2018

Again, all time closing highs

Thursday 01/04/2018...ATH

Again, all time closing highs with volume slowly creeping up this week...

Wednesday 01/03/2018

All time closing highs

ATH

Tuesday 01/02/2018

Very little movement in the YM compared to the ES and NQ