Short reviews of the day's market action after the majors close....for 2019

Link to 2018 EOD charts

------------------------------------------------------

Link to 2018 EOD charts

------------------------------------------------------

12/31/2019 Tuesday - New Years Eve

12/30/2019 Monday

12/27/2019 Friday

12/26/2019 Thursday

12/24/2019 Tuesday Christmas Eve

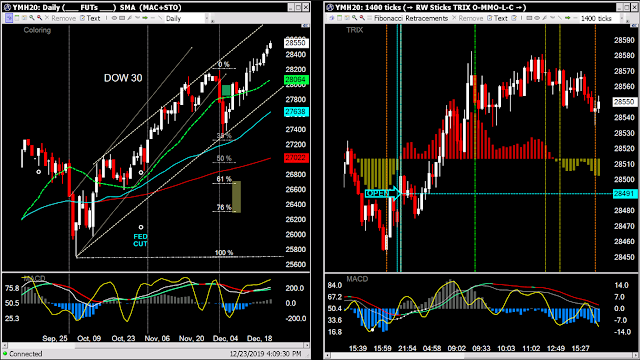

12/23/2019 Monday

12/20/2019 Friday

Everything closing in record territory

12/19/2019 Thursday

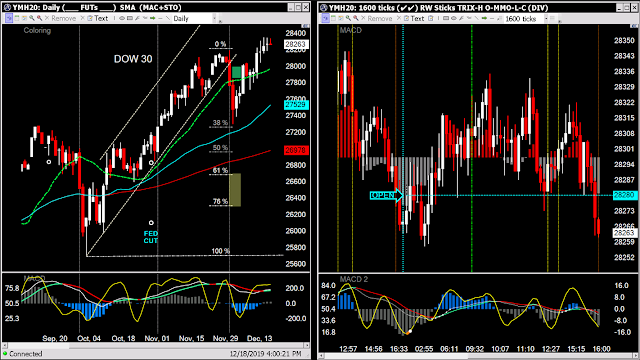

12/18/2019 Wednesday

Congress impeachment farce vote tonight

Rolled to the March 2020 contract

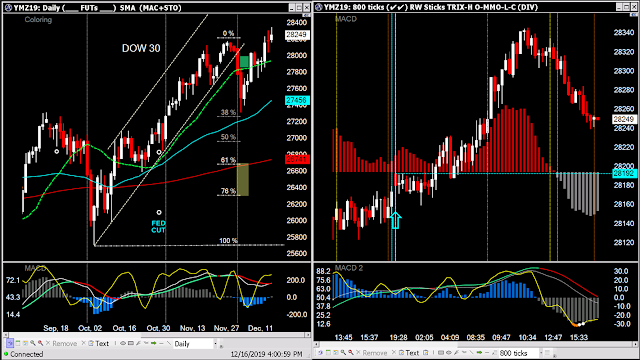

12/17/2019 Tuesday

12/16/2019 Monday

12/13/2019 Friday

Closing spinning doji

12/12/2019 Thursday

Big volume up day...all indices went into record territory

12/11/2019 Wednesday

MACD Crosses this year

12/10/2019 Tuesday

...

Tuesday morning

12/09/2019 Monday

12/06/2019 Friday

Daily and 5 sessions

Daily and last session

12/05/2019 Thursday

12/04/2019 Wednesday

12/03/2019 Tuesday

Another big down move...doubts about a China trade deal??

Meanwhile PDT attends NATO meeting "squeezing" our allies

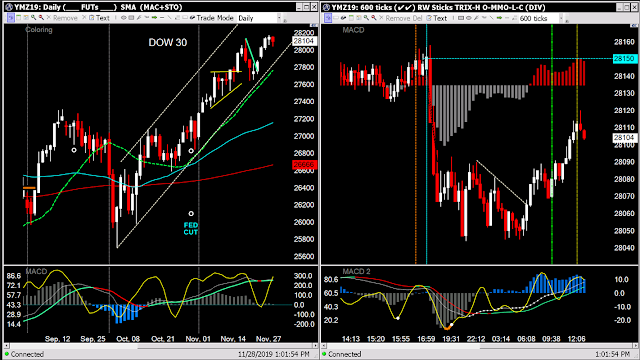

12/02/2019 Monday

Testing the lower channel line and the 20 SMAs on increased volume

11/29/2019 Friday - 1/2 session

11/28/2019 Thursday

Thanksgiving holiday - 1/2 session

11/27/2019 Wednesday

YM was only up a smidgen compared to the others...

11/26/2019 Tuesday

New highs hit across the boards

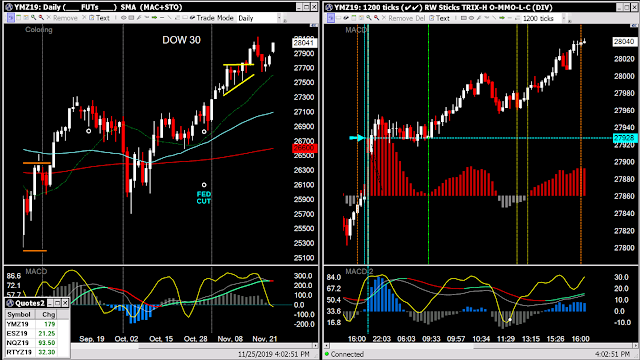

11/25/2019 Monday

Gaps -- Low volume, low activity albeit good positive price moves.

11/22/2019 Friday

Lower volume

11/21/2019 Thursday

11/19/2019 Tuesday

11/18/2019 Monday

11/15/2019 Friday

This is not your father's politics.

The market still reflects American Greatness.

11/14/2019 Thursday

11/13/2019 Wednesday

House opens formal impeachment hearing...a scripted show

11/12/2019 Tuesday

11/08/2019 Friday

11/07/2019 Thursday

Thursday morning MACD TREND

While the US and Europe sleep...

11/06/2019 Wednesday

11/05/2019 Tuesday

11/04/2019 Monday

11/01/2019 Friday

At the major market close

10/31/2019 Thursday

Nice little divergent 2B reversal before the majors closed

10/30/2019 Wednesday...Fed cut 1/4 point

Has the Fed become irreverent under MAGAnomics?

10/29/2019 Tuesday

Relatively low volume resulting in small spinner/doji closing candles.

10/28/2019 Monday

10/25/2019 Friday

10/24/2019 Thursday

10/23/2019 Wednesday

FED DAY

10/22/2019 Tuesday

10/21/2019 Monday

10/18/2019 Friday

10/17/2019 Thursday

Turkey/Syria cease fire

10/16/2019 Wednesday

Bipartisan bill passes the House

"We must not abandon the Kurds"

10/15/2019 Tuesday

10/14/2019 Monday

10/11/2019 Friday

10/10/2019 Thursday -- wide range

10/09/2019 Wednesday

10/08/2019 Tuesday

10/07/2019 Monday

10/04/2019 Friday

10/03/2019 Thursday

10/02/2019 Wednesday

Big drop out of the wedge to the 50 sma

09/26/2019 Thursday

Wednesday mid-day

09/24/2019 Tuesday

creating Harami pairs...

09/20/2019 Friday

09/19/2019 Thursday

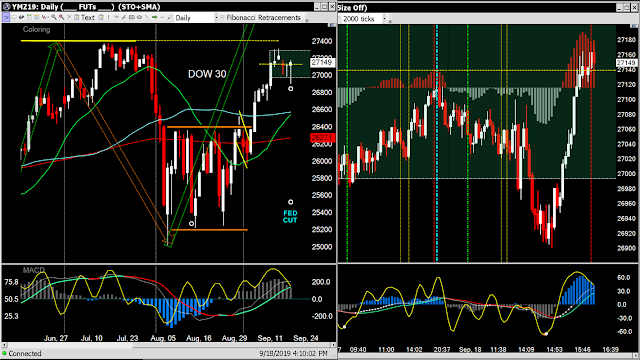

09/18/2019 Wednesday

FED cut rates 1/4 percent today

09/17/2019 Tuesday

Congressional clown show this afternoon (a repeat)

starring Corey Lewandowksi

Tues morning

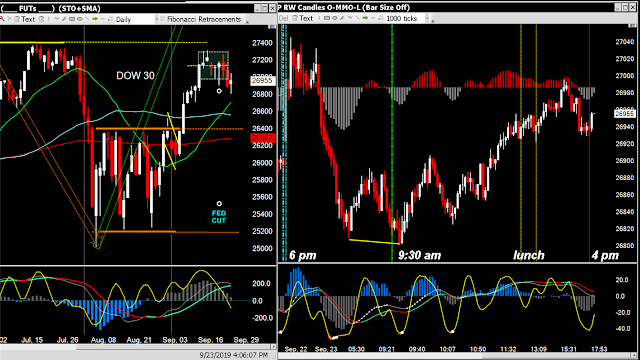

09/16/2019 Monday

Iran bombs Saudi oil works to start the week and steals

another oil tanker...Oil markets railed

Perhaps the start of a horizontal channel showing on the DOW 30

after last two week's run up...rising MACD EMAs but O/S STO ,

Prices consolidating with lower tick activity and narrow range doji

09/13/2019 Friday

09/12/2019 Thursday

09/11/2019 Wednesday

09/10/2019 Tuesday

09/09/2019 Monday

09/05/2019 Thursday

Another overnight pop

09/04/2019 Wednesday

09/03/2019 Tuesday

09/01/2019 Monday - Labor Day 1/2 session

08/30/2019 Friday

Friday morning resistance at the 50 sma

08/29/2019 Thursday

08/28/2019 Wednesday

08/27/2019 Tuesday

08/26/2019 Monday

G7 meetings + other countries

08/23/2019 Friday

08/22/2019 Thursday

08/21/2019 Wednesday

08/20/2019 Tuesday

08/19/2019 Monday

08/16/2019 Friday

08/15/2019 Thursday

High volume

Margins reset to normal this morning

08/14/2019 Wednesday

Increased overnight margins put in place...

08/13/2019 Tuesday

08/12/2019 Monday

08/09/2019 Friday

08/08/2019 Thursday

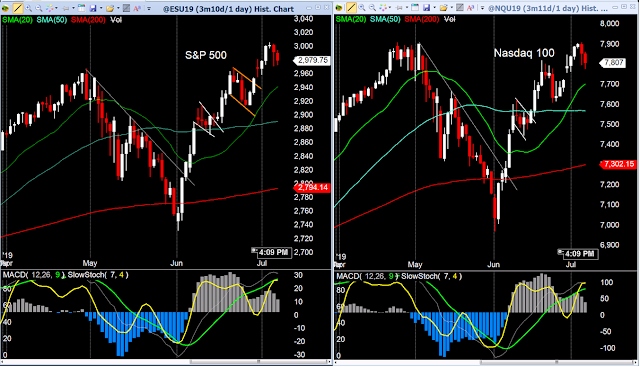

The S&P 500 and Nasdaq 100 closed within their Brach Zone

retrace areas...The DLIA and RUSSELL have retraced 50%.

08/07/2019 Wednesday

08/06/2019 Tuesday

08/05/2019 Monday

08/02/2019 Friday

08/01/2019 Thursday

07/31/2019 Wednesday

.25 FED rate cut today

Seems the markets don't like 'em today.

YM major market hours

07/30/2019 Tuesday

07/29/2019 Monday

07/25/2019 Thursday

07/23/2019 Tuesday

Just now realized the RUT is lagging

07/22/2019 Monday

07/19/2019 Friday

07/18/2019 Thursday

Volume bumping up

07/17/2019 Wednesday

07/16/2019 Tuesday

Another low volume session

07/15/2019 Monday

Very low volume and participation

07/12/2019 Friday

07/11/2019 Thursday

07/10/2019 Wednesday

07/09/2019 Tuesday

07/07/2019 Monday

07/05/2019 Friday

YM for the week

07/03/2019 Wednesday

Closed early for Independence Day

07/02/2019 Tuesday

07/01/2019 Monday

06/30/19 Sunday night gap up from the flags

following PDT's Asian trip, G20 meetings and historic visit to N. Korea...

06/28/2019 Friday

S&P 500 ends up 17% in year's first half...

Closing out June up large and the big boys are flagging again

The RUT moved up nicely

YM for the week and Friday's session

06/27/2019 Thursday

Thurs morning

06/26/2019 Wednesday

Ranging above/below the session open today, Stochastic reversing

divergence became apparent on the dailies due to yest's drop

06/25/2019 Tuesday

06/24/2019 Monday

YM hourly bars for the week

06/20/2019 Thursday

06/19/2019 Wednesday

06/18/2019 Tuesday

YM 15 min full session and 60 min 5 sessions

06/17/2019 Monday

Should have rolled to Sept contract yesterday

06/14/2019 Friday

Sideways for the week, still digesting last week's historic run

06/13/2019 Thursday

Big boys still going sideways in the Brach Zone

The RUT starting to play catch-up

YM - Last hour into the close and the full session

06/12/2019 Wednesday

Seems the Brach Zones are a barrier to continued up-side

06/11/2019 Tuesday

Another session of indecision at the BZs

06/10/2019 Monday

Indecisive spinners in the BZ...the NQ has almost caught up to the big boys

The RUT is still lagging

Sunday night gaps to open the session

Exhaustion or continuation?

Mexico tariffs and big tech anti-trust worries were shrugged off...

06/07/2019 Friday

Big boys leading the charge

NQ rallying strong - almost a 2% move...RUT still far behind

What a trend day looks like in the YM

Friday morning...

A lot of movement into the 'safety' of the big boys...?

The tech anti-trust worries...forgotten?

The little guys seem a bit more reluctant to say good-bye to May

but might be coming around today...

06/09/2019 Thursday

Seems the money is moving into the 'safety' of the big boys...

The RUT is hesitating - back to back spinning doji...

NQ recovering nicely from Monday's tech anti-trust fears.

06/05/2019 Wednesday

Good follow through to yesterday, YM+ES breaking the trend lines

Stochastic hooking up.

Good follow through for the NQ, not quite to it's trend line.

The RUT was more tentative, closing with an indecisive spinning doji

06/04/2019 Tuesday

The trend is your friend

06/03/2019 Monday

Google, FaceBook and Amazon facing investigation

05/31/2019 Friday

"Sell in May" ... Friday's excuse -- tariffs being put on all Mexican goods until

they do something about the illegal hoards they are aiding and abetting...

Next support looks like the 2nd leg of the measured moves.

05/30/2019 Thursday

05/29/2019 Wednesday

05/28/2019 Tuesday

05/27/2019 Monday ★☆★Memorial Day★☆★

-- session closed early today --

05/24/2019 Friday

Daily and the week's sessions

05/23/2019 Thursday

Overnight Hi-Lo Z day

05/22/2019 Wednesday

05/21/2019 Tuesday

Before the majors opened

05/20/2019 Monday

05/17/2019

05/16/2019 Thursday

05/15/2019 Wednesday

05/14/2019 Tuesday

05/13/2019 Monday

05/10/2019 Friday

05/09/2019 Thursday

05/08/2019 Wednesday

05/07/2019 Tuesday

05/06/2019 Monday evening

05/06/2019 Monday

05/02/2019 Thursday

05/01/2019 Wednesday

Fantastic economic news - "the economy grew by 3.2 percent in the 1st quarter"

and the FED holds rates this week...Markets are tired of good news...

04/30/2019 Tuesday

04/29/2019 Monday

04/26/2019 Friday

04/25/2019 Thursday

04/24/2019 Wednesday

04/23/2019 Tuesday

04/22/2019 Monday

04/18/2019 Thursday

Happy Mueller report day - what a crock

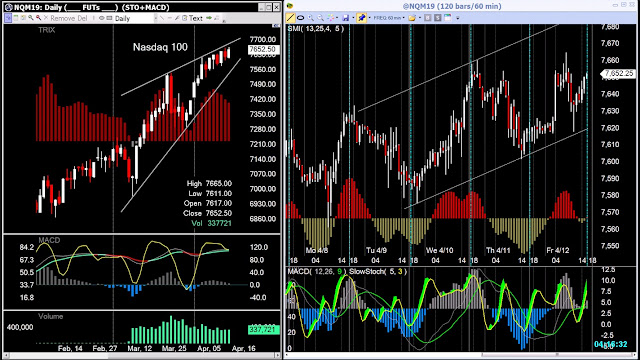

Daily plus 1 1/2 session 30 minute charts showing

6 PM, 9:30 AM MMO, lunch hour and the MMO Close

04/17/2019 Wednesday

A bit more volume came in, copy of yesterday's price action at the MMO

04/16/2019 Tuesday

Finding some new features "hidden" within MT software

04/15/2019 Monday

Low volume again...spinning doji, little change

Dailies and full sessions:

04/12/2019 Friday

Volume came back to more normal levels.

YM -- one up day erases 4 down days

ES -- popped nicely

04/11/2019 Thursday

Wow - volume down substantially...was bugging me, thinking about the "why" ...

so I rechecked the contract expiry dates to be sure that wasn't the cause:

These are 3 month dailies and 60 minute candles for the full sessions:

04/10/2019 Wednesday

Low volume...the little guys showing more up action than the biggies

Here's Apex followed by Medved

Medved - Daily and 3 sessions,1 hour candles

04/09/2019 Tuesday

Starting to really appreciate the Medved Trader program

YM 5 sessions

04/08/2019 Monday

Very low volume again today

YM full session (15 minute) and the past few (60 minute)

04/05/2019 Friday

10 sessions -- UP -- Dailies and full sessions, 15 minute candles

04/04/2019 Thursday

YM -- 2 sessions and thursday's MMO

04/03/2019 Wednesday

04/02/2019 Tuesday

Very low volume -- NOT due to contract rollover issues

04/01/2019 Monday

YM -- 30 minute and 5 minute candles

03/29/2019 Friday

Ending the week up but basically UNCH compared to last week

YM - past 5 sessions breaking out of the wedge...also showing Friday's MMO session

03/28/2019 Thursday

End of Month...Care to guess what happens tomorrow?

03/27/2019 Wednesday

YM 15m + 5m

03/26/2019 Tuesday

03/25/2019 Monday

03/22/2019 Friday

Increased volume with large percentage moves down, especially in the Russell

Complete YM session and MMO

03/21/2019 Thursday

Complete YM session and MMO

03/20/2019 Wednesday

FED day (as of 2:30)

03/20/2019 Wednesday morning

Dropped out of it's channel @ the 9:30 MMO

Channel holding in the overnight market thru 8:15 AM

03/19/2019 Tuesday

YM spans it's channel again

12/30/2019 Monday

12/27/2019 Friday

12/26/2019 Thursday

12/24/2019 Tuesday Christmas Eve

12/23/2019 Monday

12/20/2019 Friday

Everything closing in record territory

12/19/2019 Thursday

Congress impeachment farce vote tonight

Rolled to the March 2020 contract

12/17/2019 Tuesday

12/16/2019 Monday

12/13/2019 Friday

Closing spinning doji

12/12/2019 Thursday

Big volume up day...all indices went into record territory

12/11/2019 Wednesday

MACD Crosses this year

12/10/2019 Tuesday

...

Tuesday morning

12/09/2019 Monday

12/06/2019 Friday

Daily and 5 sessions

Daily and last session

12/05/2019 Thursday

12/04/2019 Wednesday

12/03/2019 Tuesday

Another big down move...doubts about a China trade deal??

Meanwhile PDT attends NATO meeting "squeezing" our allies

12/02/2019 Monday

Testing the lower channel line and the 20 SMAs on increased volume

11/29/2019 Friday - 1/2 session

11/28/2019 Thursday

Thanksgiving holiday - 1/2 session

11/27/2019 Wednesday

YM was only up a smidgen compared to the others...

11/26/2019 Tuesday

New highs hit across the boards

11/25/2019 Monday

Gaps -- Low volume, low activity albeit good positive price moves.

11/22/2019 Friday

Lower volume

11/21/2019 Thursday

11/19/2019 Tuesday

11/18/2019 Monday

11/15/2019 Friday

This is not your father's politics.

The market still reflects American Greatness.

11/14/2019 Thursday

11/13/2019 Wednesday

House opens formal impeachment hearing...a scripted show

11/12/2019 Tuesday

11/11/2019 Monday

11/08/2019 Friday

Thursday morning MACD TREND

While the US and Europe sleep...

11/06/2019 Wednesday

11/05/2019 Tuesday

11/04/2019 Monday

11/01/2019 Friday

At the major market close

At the session close

10/31/2019 Thursday

Nice little divergent 2B reversal before the majors closed

10/30/2019 Wednesday...Fed cut 1/4 point

Has the Fed become irreverent under MAGAnomics?

10/29/2019 Tuesday

Relatively low volume resulting in small spinner/doji closing candles.

10/28/2019 Monday

10/25/2019 Friday

10/23/2019 Wednesday

FED DAY

10/22/2019 Tuesday

10/21/2019 Monday

10/18/2019 Friday

10/17/2019 Thursday

Turkey/Syria cease fire

10/16/2019 Wednesday

Bipartisan bill passes the House

"We must not abandon the Kurds"

10/15/2019 Tuesday

10/14/2019 Monday

10/11/2019 Friday

10/10/2019 Thursday -- wide range

10/09/2019 Wednesday

10/08/2019 Tuesday

10/07/2019 Monday

10/03/2019 Thursday

10/02/2019 Wednesday

10/01/2019 Tuesday

Big drop out of the wedge to the 50 sma

09/30/2019 Monday

Low volume - approaching the apex of a wedge

09/27/2019 Friday

09/26/2019 Thursday

09/25/2019 Wednesday

Wednesday mid-day

09/24/2019 Tuesday

09/23/2019 Monday

Closing with indecisive low volume spinner doji creating Harami pairs...

09/20/2019 Friday

09/19/2019 Thursday

Rolled to the December contract yesterday

09/18/2019 Wednesday

FED cut rates 1/4 percent today

US economy has been growing strongly while the rest

of the world's economies are flailing.

This despite the FED steadily implementing rising rates from 2016.

Who'a thunk that MAGAnomics could work?

Makes me wonder what could have happened had the FED refrained

from interfering...have they lost their mojo?

09/17/2019 Tuesday

Congressional clown show this afternoon (a repeat)

starring Corey Lewandowksi

Tues morning

09/16/2019 Monday

Iran bombs Saudi oil works to start the week and steals

another oil tanker...Oil markets railed

Perhaps the start of a horizontal channel showing on the DOW 30

after last two week's run up...rising MACD EMAs but O/S STO ,

Prices consolidating with lower tick activity and narrow range doji

09/13/2019 Friday

09/12/2019 Thursday

09/11/2019 Wednesday

09/10/2019 Tuesday

09/09/2019 Monday

09/06/2019 Friday

09/05/2019 Thursday

Another overnight pop

09/04/2019 Wednesday

09/03/2019 Tuesday

09/01/2019 Monday - Labor Day 1/2 session

08/30/2019 Friday

Friday morning resistance at the 50 sma

08/29/2019 Thursday

08/28/2019 Wednesday

08/27/2019 Tuesday

08/26/2019 Monday

G7 meetings + other countries

08/23/2019 Friday

08/22/2019 Thursday

08/20/2019 Tuesday

08/19/2019 Monday

08/16/2019 Friday

08/15/2019 Thursday

High volume

08/14/2019 Wednesday

Increased overnight margins put in place...

08/13/2019 Tuesday

08/12/2019 Monday

08/09/2019 Friday

The S&P 500 and Nasdaq 100 closed within their Brach Zone

retrace areas...The DLIA and RUSSELL have retraced 50%.

08/07/2019 Wednesday

08/06/2019 Tuesday

08/05/2019 Monday

08/02/2019 Friday

08/01/2019 Thursday

07/31/2019 Wednesday

.25 FED rate cut today

Seems the markets don't like 'em today.

YM major market hours

07/30/2019 Tuesday

07/29/2019 Monday

07/26/2019 Friday

Back to low volume to cap the week.

07/25/2019 Thursday

07/24/2019 Wednesday

Dem's last gasp - Mueller testimony07/23/2019 Tuesday

Just now realized the RUT is lagging

07/22/2019 Monday

07/19/2019 Friday

07/18/2019 Thursday

Volume bumping up

07/17/2019 Wednesday

07/16/2019 Tuesday

Another low volume session

07/15/2019 Monday

Very low volume and participation

07/12/2019 Friday

07/11/2019 Thursday

07/10/2019 Wednesday

07/09/2019 Tuesday

07/07/2019 Monday

07/05/2019 Friday

YM for the week

07/03/2019 Wednesday

Closed early for Independence Day

07/02/2019 Tuesday

07/01/2019 Monday

06/30/19 Sunday night gap up from the flags

following PDT's Asian trip, G20 meetings and historic visit to N. Korea...

06/28/2019 Friday

S&P 500 ends up 17% in year's first half...

Closing out June up large and the big boys are flagging again

The RUT moved up nicely

YM for the week and Friday's session

06/27/2019 Thursday

Thurs morning

06/26/2019 Wednesday

Ranging above/below the session open today, Stochastic reversing

divergence became apparent on the dailies due to yest's drop

06/25/2019 Tuesday

06/24/2019 Monday

Low volume, narrow range

06/21/2019 Friday

YM hourly bars for the week

06/20/2019 Thursday

06/19/2019 Wednesday

06/18/2019 Tuesday

Big upward ranges on volume...

LOL - measured moves would put the

Industrials over 27500 and the S&P over 3000

YM 15 min full session and 60 min 5 sessions

06/17/2019 Monday

Should have rolled to Sept contract yesterday

Sideways for the week, still digesting last week's historic run

06/13/2019 Thursday

Big boys still going sideways in the Brach Zone

The RUT starting to play catch-up

YM - Last hour into the close and the full session

06/12/2019 Wednesday

Seems the Brach Zones are a barrier to continued up-side

06/11/2019 Tuesday

Another session of indecision at the BZs

06/10/2019 Monday

Indecisive spinners in the BZ...the NQ has almost caught up to the big boys

The RUT is still lagging

Sunday night gaps to open the session

Exhaustion or continuation?

Mexico tariffs and big tech anti-trust worries were shrugged off...

06/07/2019 Friday

Big boys leading the charge

NQ rallying strong - almost a 2% move...RUT still far behind

What a trend day looks like in the YM

Friday morning...

A lot of movement into the 'safety' of the big boys...?

The tech anti-trust worries...forgotten?

The little guys seem a bit more reluctant to say good-bye to May

but might be coming around today...

Seems the money is moving into the 'safety' of the big boys...

The RUT is hesitating - back to back spinning doji...

NQ recovering nicely from Monday's tech anti-trust fears.

06/05/2019 Wednesday

Good follow through to yesterday, YM+ES breaking the trend lines

Stochastic hooking up.

Good follow through for the NQ, not quite to it's trend line.

The RUT was more tentative, closing with an indecisive spinning doji

06/04/2019 Tuesday

The trend is your friend

06/03/2019 Monday

Google, FaceBook and Amazon facing investigation

05/31/2019 Friday

"Sell in May" ... Friday's excuse -- tariffs being put on all Mexican goods until

they do something about the illegal hoards they are aiding and abetting...

Next support looks like the 2nd leg of the measured moves.

05/30/2019 Thursday

05/29/2019 Wednesday

05/28/2019 Tuesday

05/27/2019 Monday ★☆★Memorial Day★☆★

-- session closed early today --

05/24/2019 Friday

Daily and the week's sessions

Daily and current session

05/23/2019 Thursday

Overnight Hi-Lo Z day

05/22/2019 Wednesday

05/21/2019 Tuesday

Before the majors opened

05/20/2019 Monday

05/17/2019

05/16/2019 Thursday

05/15/2019 Wednesday

05/14/2019 Tuesday

05/13/2019 Monday

05/10/2019 Friday

05/09/2019 Thursday

05/08/2019 Wednesday

05/07/2019 Tuesday

05/06/2019 Monday evening

05/06/2019 Monday

05/02/2019 Thursday

05/01/2019 Wednesday

Fantastic economic news - "the economy grew by 3.2 percent in the 1st quarter"

and the FED holds rates this week...Markets are tired of good news...

04/30/2019 Tuesday

04/29/2019 Monday

04/26/2019 Friday

04/25/2019 Thursday

04/24/2019 Wednesday

04/23/2019 Tuesday

04/22/2019 Monday

04/18/2019 Thursday

Happy Mueller report day - what a crock

Daily plus 1 1/2 session 30 minute charts showing

6 PM, 9:30 AM MMO, lunch hour and the MMO Close

04/17/2019 Wednesday

A bit more volume came in, copy of yesterday's price action at the MMO

04/16/2019 Tuesday

Finding some new features "hidden" within MT software

04/15/2019 Monday

Low volume again...spinning doji, little change

Dailies and full sessions:

04/12/2019 Friday

Volume came back to more normal levels.

YM -- one up day erases 4 down days

ES -- popped nicely

04/11/2019 Thursday

Wow - volume down substantially...was bugging me, thinking about the "why" ...

so I rechecked the contract expiry dates to be sure that wasn't the cause:

These are 3 month dailies and 60 minute candles for the full sessions:

04/10/2019 Wednesday

Low volume...the little guys showing more up action than the biggies

Here's Apex followed by Medved

Medved - Daily and 3 sessions,1 hour candles

04/09/2019 Tuesday

Starting to really appreciate the Medved Trader program

YM 5 sessions

04/08/2019 Monday

Very low volume again today

YM full session (15 minute) and the past few (60 minute)

04/05/2019 Friday

10 sessions -- UP -- Dailies and full sessions, 15 minute candles

YM -- 5 sessions with 1 hour candles

04/04/2019 Thursday

YM -- 2 sessions and thursday's MMO

04/03/2019 Wednesday

04/02/2019 Tuesday

Very low volume -- NOT due to contract rollover issues

04/01/2019 Monday

YM -- 30 minute and 5 minute candles

03/29/2019 Friday

Ending the week up but basically UNCH compared to last week

YM - past 5 sessions breaking out of the wedge...also showing Friday's MMO session

03/28/2019 Thursday

End of Month...Care to guess what happens tomorrow?

03/27/2019 Wednesday

YM 15m + 5m

03/26/2019 Tuesday

03/25/2019 Monday

03/22/2019 Friday

Increased volume with large percentage moves down, especially in the Russell

Complete YM session and MMO

03/21/2019 Thursday

Complete YM session and MMO

03/20/2019 Wednesday

FED day (as of 2:30)

03/20/2019 Wednesday morning

Dropped out of it's channel @ the 9:30 MMO

Channel holding in the overnight market thru 8:15 AM

03/19/2019 Tuesday

YM spans it's channel again

03/18/2018 Monday

Daily and 15 minute:

RTY daily and 5 minute

03/15/2019 Friday

Tweezer bottom (Fri-Mon) preceded the week's run up

03/14/2019 Thursday

03/13/2019 Wednesday

Rolled to June contract

03/12/2019 Tuesday

03/11/2019 Monday

Seems the Harami Hammer reversed the trend -- long legged tweezers on the YM

03/08/2019 Friday

Down thru the overnight, closing little changed with Harami Hammers.

03/07/2019 Thursday

03/06/2019 Wednesday

03/05/2019 Tuesday

03/04/2019 Monday

03/01/2019 Friday

February 2019

02/28/2019 Thursday

02/27/2019 Wednesday

02/26/2019 Tuesday

02/25/2019 Monday

Expected the news about China negotiations would strongly drive the markets...(not yet? )

Daily and 15 minute:

RTY daily and 5 minute

Tweezer bottom (Fri-Mon) preceded the week's run up

03/14/2019 Thursday

Rolled to June contract

03/12/2019 Tuesday

YM 15 min full session and 60 min 3 sessions

03/11/2019 Monday

Seems the Harami Hammer reversed the trend -- long legged tweezers on the YM

Down thru the overnight, closing little changed with Harami Hammers.

03/06/2019 Wednesday

03/05/2019 Tuesday

03/04/2019 Monday

03/01/2019 Friday

February 2019

02/28/2019 Thursday

02/26/2019 Tuesday

Expected the news about China negotiations would strongly drive the markets...(not yet? )

02/19/2019 Tuesday

02/18/2019 Monday

President's Day short session

The retail sales worries @8:30 were forgotten by lunch, +75% BZ retrace.

Next hobgoblin news around 3 PM - PDT will sign the bill "ending" a 2nd shut-down threat

but will also announce a National Emergency regarding the border situation.

...so what happened at 8:30 this morning?

Financial news rational - retail sales in the U.S. dropped by the largest amount since September 2009

02/13/2019 Wednesday

02/12/2019 Tuesday

02/11/2019 Monday

02/08/2019 Friday

Harami Hammer patterns - a potential reverse of downturn signal

02/07/2019 Thursday

02/06/2019 Wednesday

02/05/2019 Tuesday - SOTU tonight

02/04/2019 Monday

Low volume session

Strong into the close

02/01/2019 Friday